Medicare Part B Premiums in 2025: A Look at the Future of Senior Healthcare Costs

Medicare Part B Premiums in 2025: A Look at the Future of Senior Healthcare Costs

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Medicare Part B Premiums in 2025: A Look at the Future of Senior Healthcare Costs. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Medicare Part B Premiums in 2025: A Look at the Future of Senior Healthcare Costs

Medicare Part B, which covers physician services, outpatient care, and medical equipment, is a vital component of healthcare for millions of Americans aged 65 and older. Understanding the cost of Part B premiums is essential for seniors planning their retirement finances and navigating healthcare expenses. While the exact premium for 2025 remains unknown, analyzing historical trends and current factors can provide insights into potential changes.

Factors Influencing Medicare Part B Premiums:

Several factors contribute to the annual adjustments of Medicare Part B premiums. These include:

- Projected Healthcare Costs: The Centers for Medicare and Medicaid Services (CMS) forecasts healthcare spending trends and adjusts premiums accordingly. Rising healthcare costs, driven by factors like technological advancements and an aging population, often lead to premium increases.

- Medicare Trust Fund Performance: The financial health of the Medicare Trust Fund impacts premium adjustments. If the fund experiences deficits, premiums may increase to compensate for the shortfall.

- Inflation: The Consumer Price Index (CPI) serves as a primary indicator of inflation. Higher inflation rates can result in increased premiums to maintain the purchasing power of benefits.

- Enrollment Growth: As more individuals enroll in Medicare, the cost of providing benefits to a larger population can necessitate premium adjustments.

Historical Trends and Projections:

Examining past trends can provide a glimpse into potential future premium changes. In recent years, Medicare Part B premiums have generally experienced annual increases, reflecting the factors mentioned above. While the exact percentage increase for 2025 is yet to be determined, experts project a continuation of this trend.

Understanding the Impact of Premium Increases:

Higher Medicare Part B premiums can directly affect seniors’ budgets. Increased costs can strain retirement savings, leading to difficult choices between healthcare expenses and other essential needs.

Potential Mitigation Strategies:

Several strategies can help seniors navigate the potential impact of rising Medicare Part B premiums:

- Budgeting and Planning: Developing a detailed budget that incorporates healthcare costs, including potential premium increases, is crucial.

- Exploring Savings Options: Consider utilizing tax-advantaged savings accounts like Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) to help offset healthcare expenses.

- Reviewing Coverage Options: Examine different Medicare Advantage plans, which may offer lower premiums and additional benefits compared to traditional Medicare.

- Seeking Financial Counseling: Consult with a financial advisor to develop a personalized plan for managing healthcare costs during retirement.

FAQs:

Q: When will the Medicare Part B premium for 2025 be announced?

A: The CMS typically announces the Medicare Part B premium for the upcoming year in the fall of the preceding year. Therefore, the 2025 premium is expected to be announced in the fall of 2024.

Q: How are Medicare Part B premiums calculated?

A: The CMS uses a complex formula to calculate premiums, taking into account factors like projected healthcare costs, the performance of the Medicare Trust Fund, and inflation.

Q: Can I avoid paying Medicare Part B premiums?

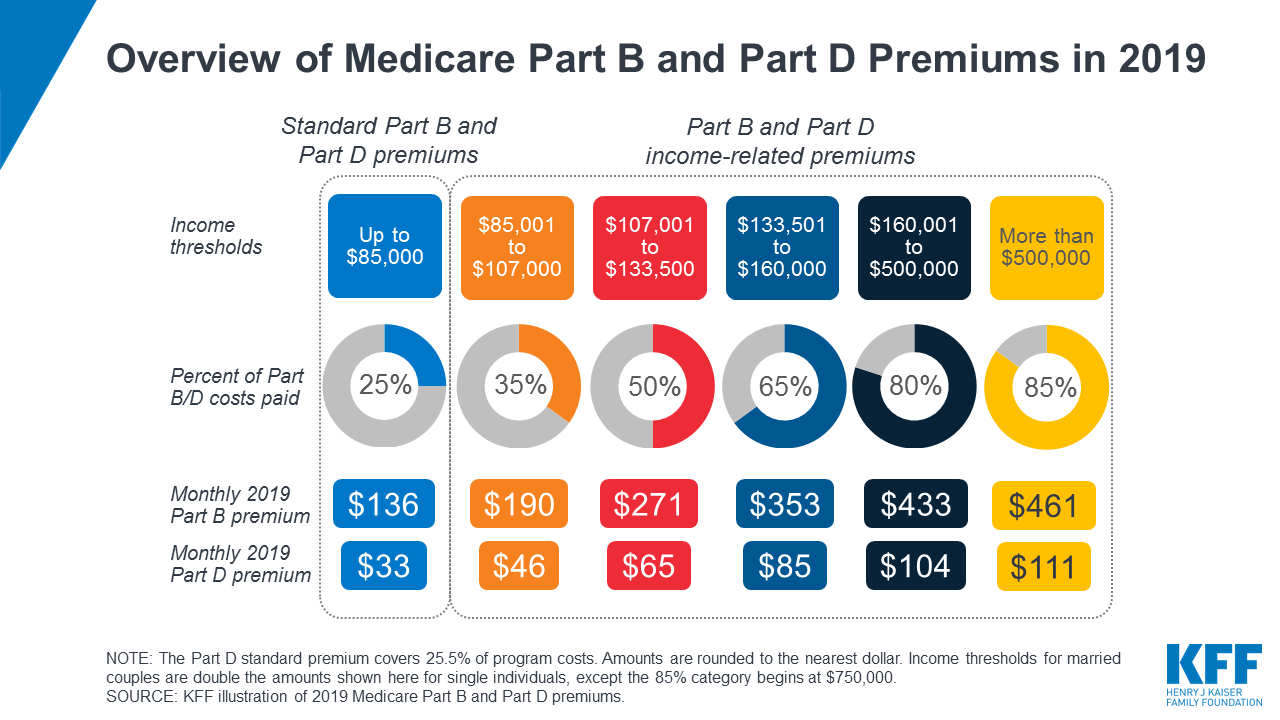

A: While you cannot avoid paying premiums entirely, some individuals may be eligible for premium assistance programs based on their income level.

Q: What happens if I cannot afford the Medicare Part B premium?

A: If you are struggling to pay your premiums, you can contact the Social Security Administration or your local Medicare office to explore options like premium assistance programs or enrollment in a different Medicare plan.

Tips for Managing Medicare Part B Premiums:

- Stay Informed: Monitor announcements from the CMS regarding premium changes and updates.

- Review Your Coverage Regularly: Ensure your Medicare plan meets your current healthcare needs and consider switching to a different plan if necessary.

- Explore Cost-Saving Options: Research ways to reduce healthcare expenses, such as generic medications or preventive care services.

Conclusion:

Predicting the exact Medicare Part B premium for 2025 remains uncertain. However, understanding the factors influencing these costs and implementing proactive strategies can help seniors navigate the challenges of rising healthcare expenses. By staying informed, planning ahead, and exploring available resources, seniors can make informed decisions about their healthcare coverage and ensure their financial well-being during retirement.

![]()

Closure

Thus, we hope this article has provided valuable insights into Medicare Part B Premiums in 2025: A Look at the Future of Senior Healthcare Costs. We hope you find this article informative and beneficial. See you in our next article!