Navigating Medicare Part B in 2025: Understanding Premiums and Deductibles for Seniors

Navigating Medicare Part B in 2025: Understanding Premiums and Deductibles for Seniors

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Medicare Part B in 2025: Understanding Premiums and Deductibles for Seniors. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Medicare Part B in 2025: Understanding Premiums and Deductibles for Seniors

Medicare Part B, also known as Medical Insurance, is a vital component of the Medicare program for seniors and people with disabilities. It covers a wide range of medical services, including doctor visits, outpatient care, and preventive screenings. However, Part B comes with a cost, and understanding the associated premiums and deductibles is essential for beneficiaries to effectively manage their healthcare expenses.

Understanding the Fundamentals

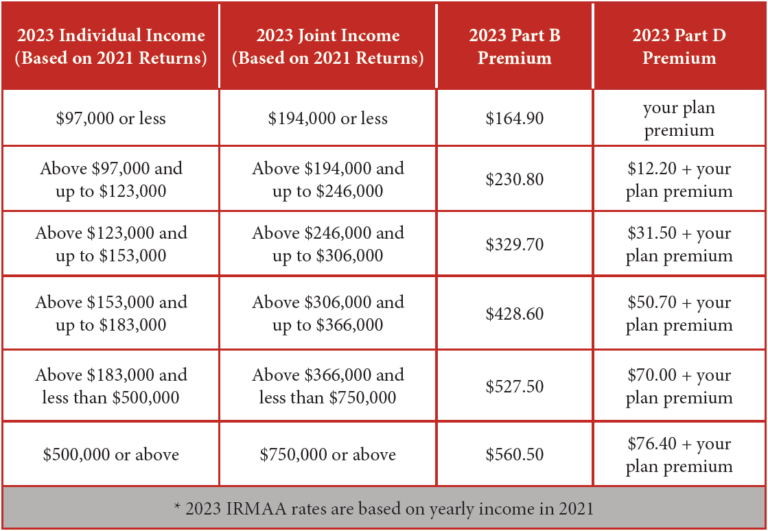

- Premium: This is a monthly fee paid by beneficiaries to access Part B benefits. The premium amount is determined by income, with higher-income individuals paying more.

- Deductible: This is the amount beneficiaries must pay out-of-pocket before Medicare begins covering costs for covered services. Once the deductible is met, Medicare pays 80% of the allowed amount for most services, and the beneficiary pays the remaining 20%.

2025 Projections: A Look Ahead

While the exact 2025 Medicare Part B premium and deductible figures are not yet finalized, projections offer insight into potential changes. It is important to note that these figures are subject to modification based on factors such as healthcare inflation and legislative decisions.

- Premium: The 2025 premium is estimated to increase, reflecting rising healthcare costs and the ongoing expansion of Part B benefits.

- Deductible: The 2025 deductible is also projected to increase, though the specific amount remains uncertain.

Factors Influencing Premiums and Deductibles

Several factors influence the annual adjustments to Medicare Part B premiums and deductibles:

- Healthcare Inflation: Rising costs for medical services and supplies directly impact Medicare expenses.

- Utilization Trends: Changes in how beneficiaries use Medicare services, such as increased utilization of expensive treatments, contribute to cost fluctuations.

- Legislative Decisions: Congressional actions, such as changes to Medicare benefits or funding levels, can impact premiums and deductibles.

Importance of Staying Informed

Staying informed about potential changes to Medicare Part B premiums and deductibles is crucial for beneficiaries. Understanding these costs allows for effective financial planning and proactive management of healthcare expenses.

How to Stay Informed:

- Annual Enrollment Period: The annual enrollment period for Medicare Part B is from October 15 to December 7 each year. During this time, beneficiaries can review their coverage and make changes if needed.

- Medicare.gov: The official Medicare website, Medicare.gov, provides up-to-date information on premiums, deductibles, and other relevant details.

- Social Security Administration: The Social Security Administration website also offers resources on Medicare benefits and costs.

FAQs on Medicare Part B Premiums and Deductibles

Q: How are Medicare Part B premiums determined?

A: Medicare Part B premiums are calculated based on income. Higher-income beneficiaries pay a higher premium, while those with lower incomes pay a lower premium.

Q: Can I avoid paying Medicare Part B premiums?

A: No, Medicare Part B premiums are mandatory for most beneficiaries. However, there are some exceptions, such as individuals who receive Medicare benefits through certain government programs.

Q: What happens if I cannot afford my Medicare Part B premium?

A: The Social Security Administration offers a program called the "Low-Income Subsidy," which can help individuals with limited income pay their Medicare Part B premiums.

Q: Can I change my Medicare Part B coverage during the year?

A: You can only change your Medicare Part B coverage during the annual enrollment period (October 15 to December 7) or during a special enrollment period, such as when you move or change your health status.

Q: How can I find out my Medicare Part B deductible for 2025?

A: The exact 2025 deductible will be announced by the Centers for Medicare and Medicaid Services (CMS) closer to the beginning of the year. You can find this information on Medicare.gov and through your Social Security Administration statement.

Tips for Managing Medicare Part B Costs

- Explore Coverage Options: Carefully review your Medicare Part B coverage and consider enrolling in a Medicare Advantage plan, which may offer lower premiums and copayments.

- Seek Preventive Services: Take advantage of preventive screenings and services covered by Medicare Part B to potentially avoid more costly health issues in the future.

- Shop for Prescription Drugs: Compare prescription drug prices and explore options for saving on medications.

- Utilize Medicare Resources: Contact your local Medicare office or visit Medicare.gov for assistance with understanding your benefits and managing your costs.

Conclusion

Understanding the intricacies of Medicare Part B premiums and deductibles is essential for seniors and individuals with disabilities. By staying informed about potential changes, exploring available resources, and making informed decisions about their healthcare coverage, beneficiaries can effectively manage their costs and access the necessary medical services.

Closure

Thus, we hope this article has provided valuable insights into Navigating Medicare Part B in 2025: Understanding Premiums and Deductibles for Seniors. We appreciate your attention to our article. See you in our next article!