Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide

Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide

Medicare Part B, the medical insurance component of the Medicare program, covers a wide range of healthcare services, including doctor visits, outpatient care, and preventive services. However, accessing these benefits comes with a cost: a monthly premium that individuals must pay to maintain their coverage. This premium, which is subject to annual adjustments, is a significant financial consideration for Medicare beneficiaries.

While the exact 2025 Medicare Part B premium remains unknown at this time, understanding the factors that influence its calculation and the potential range of costs can help individuals plan for their healthcare expenses.

Factors Influencing Medicare Part B Premiums

The annual adjustment of Medicare Part B premiums is determined by several factors, including:

- The cost of providing Medicare benefits: The rising cost of healthcare services directly impacts the premium amount. As medical treatments and technologies become more expensive, the premium needs to reflect these changes to ensure the program’s sustainability.

- The number of Medicare beneficiaries: A larger beneficiary pool can spread the cost of the program across a wider base, potentially leading to lower premiums. Conversely, a declining beneficiary pool could necessitate higher premiums to maintain coverage.

- The performance of the Social Security trust fund: The Social Security trust fund provides a significant portion of the funding for Medicare. Its financial health can influence the premium amount, with a strong fund potentially leading to lower premiums.

- Government policy decisions: Policy changes, such as adjustments to the Medicare program or changes in federal funding, can impact the premium amount.

Understanding the Premium Calculation

The annual Medicare Part B premium is calculated based on a complex formula that considers the factors mentioned above. While the specific formula is not publicly available, it generally involves estimating the cost of providing Medicare benefits for the upcoming year, factoring in the number of beneficiaries, and considering the financial health of the Social Security trust fund.

Potential Range of 2025 Medicare Part B Premiums

Predicting the exact 2025 Medicare Part B premium is impossible without access to the final calculations. However, considering historical trends and current economic conditions, experts estimate the premium could fall within a specific range.

- Historical Trends: In recent years, Medicare Part B premiums have generally seen an annual increase, though the rate of increase has varied.

- Economic Conditions: Inflation and the cost of healthcare services are key drivers of premium adjustments. High inflation rates could potentially lead to larger premium increases.

Navigating the Premium Landscape

Understanding the factors that influence Medicare Part B premiums and the potential range of costs is crucial for individuals planning for their healthcare expenses. Here are some strategies for navigating the premium landscape:

- Stay Informed: Keep abreast of any updates regarding Medicare Part B premiums. The Centers for Medicare and Medicaid Services (CMS) typically announces the premium amount for the upcoming year in the fall of the preceding year.

- Budgeting and Financial Planning: Factor the estimated Medicare Part B premium into your annual budget. Consider utilizing financial planning tools to assess your healthcare costs and create a comprehensive financial strategy.

- Consider Enrollment Options: Individuals can choose to enroll in Medicare Part B during their initial enrollment period or during open enrollment periods. Understanding the enrollment deadlines and potential penalties for late enrollment is essential.

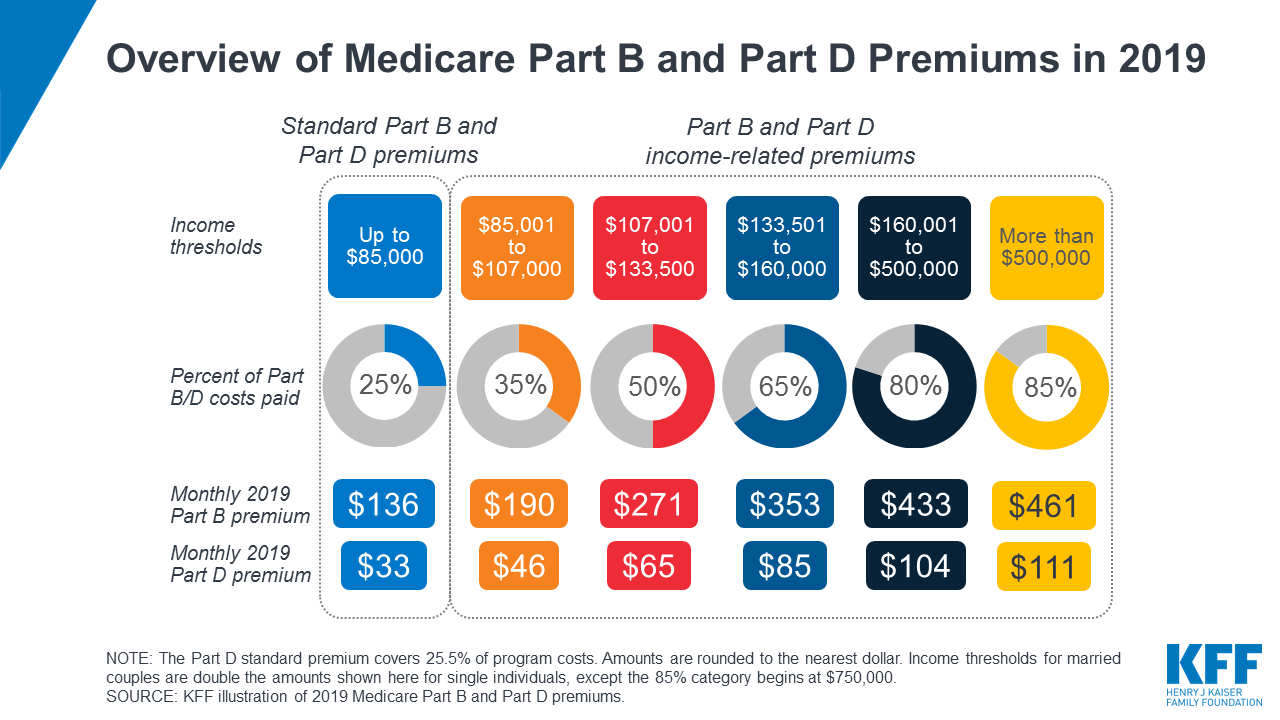

- Explore Income-Related Monthly Adjustment Amount (IRMAA): Higher-income individuals may face an additional monthly premium adjustment known as IRMAA. Familiarize yourself with the income thresholds and the potential impact on your premium.

- Seek Professional Advice: Consult with a financial advisor or Medicare specialist for personalized guidance on managing your Medicare premiums and ensuring you have the right coverage for your needs.

Frequently Asked Questions (FAQs) Regarding Medicare Part B Premiums

Q: When is the 2025 Medicare Part B premium announced?

A: The CMS typically announces the Medicare Part B premium for the upcoming year in the fall of the preceding year. This announcement provides individuals with ample time to plan for their healthcare expenses.

Q: How can I pay my Medicare Part B premium?

A: You can pay your Medicare Part B premium through various methods, including automatic deductions from your Social Security benefits, direct debit from your bank account, or by mail.

Q: What happens if I can’t afford my Medicare Part B premium?

A: If you are struggling to afford your Medicare Part B premium, you may be eligible for financial assistance programs. Contact the CMS or a Medicare specialist to explore these options.

Q: Can I appeal a Medicare Part B premium increase?

A: While you cannot directly appeal the premium amount, you can contact the CMS to inquire about the reasons for the increase.

Tips for Managing Medicare Part B Premiums

- Maximize Your Benefits: Utilize all the benefits offered by Medicare Part B, such as preventive screenings and wellness services, to ensure you are getting the most value from your coverage.

- Compare Coverage Options: Explore different Medicare Part B plans offered by private insurance companies to find the most affordable option that meets your healthcare needs.

- Shop Around for Prescription Drugs: Medicare Part D, the prescription drug coverage component of Medicare, offers different formularies and drug pricing. Compare plans to find the most cost-effective option for your medications.

- Stay Healthy: Maintain a healthy lifestyle and prioritize preventive care to reduce the likelihood of costly medical treatments.

Conclusion

Medicare Part B premiums are a significant financial consideration for Medicare beneficiaries. Understanding the factors that influence these premiums, the potential range of costs, and available resources can empower individuals to navigate this aspect of healthcare financing effectively. By staying informed, planning ahead, and seeking professional advice, individuals can ensure they have the coverage they need while managing their healthcare expenses responsibly.

![]()

Closure

Thus, we hope this article has provided valuable insights into Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!