Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide

Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide

Medicare Part B, the medical insurance component of the Medicare program, covers a wide range of medical services, including doctor visits, outpatient care, and preventive services. To access these benefits, beneficiaries pay a monthly premium, which can vary depending on individual income and other factors. Understanding the nuances of these premiums is crucial for beneficiaries to plan their healthcare finances effectively.

Understanding the 2025 Premium Landscape

The precise monthly premium for Medicare Part B in 2025 is yet to be determined. However, it is important to understand the factors that influence these costs and the mechanisms in place to ensure fairness and affordability.

- Annual Adjustments: The standard monthly premium for Medicare Part B is adjusted annually based on factors such as projected healthcare costs and changes in the Social Security cost-of-living adjustment (COLA). These adjustments aim to maintain the financial sustainability of the program.

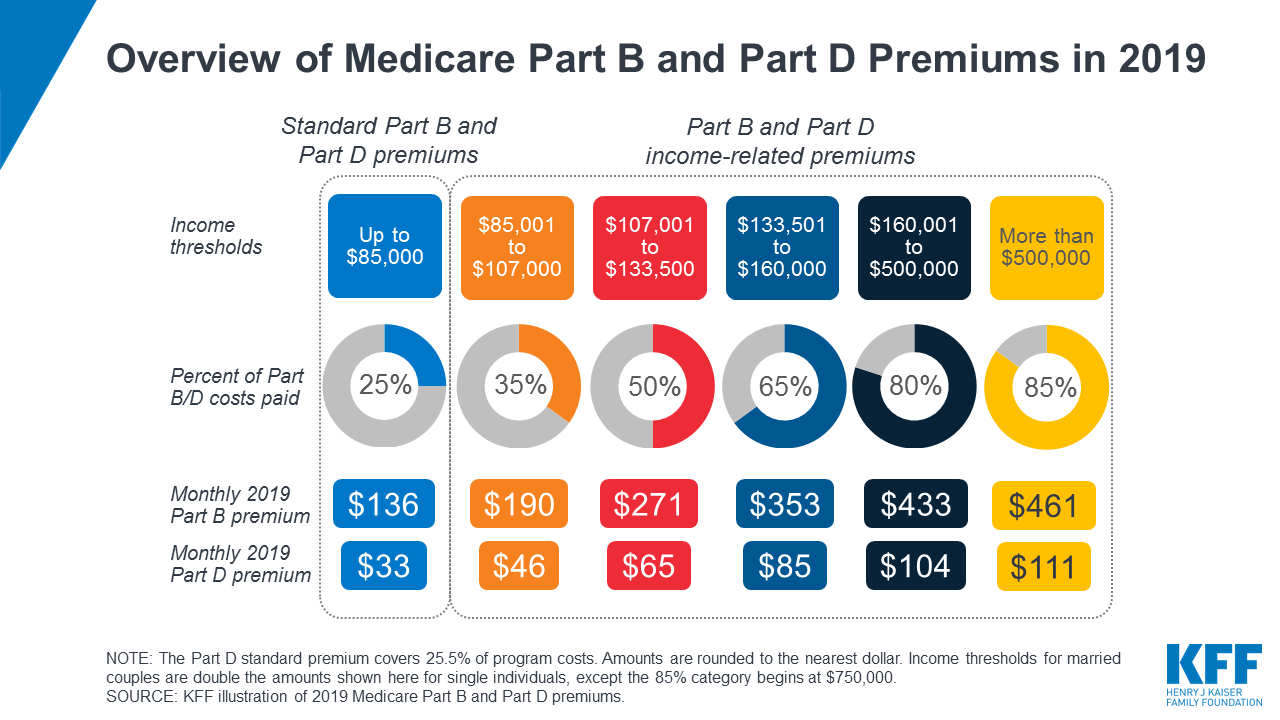

- Income-Related Monthly Adjustment Amount (IRMAA): For higher-income individuals, Medicare Part B premiums are subject to an additional monthly adjustment based on their modified adjusted gross income (MAGI). This mechanism ensures that individuals with higher incomes contribute a larger share towards the costs of the program.

- Changes in Coverage: While the core benefits of Medicare Part B remain consistent, adjustments to covered services or changes in reimbursement rates for healthcare providers can influence premium costs.

The Importance of Staying Informed

Staying abreast of changes to Medicare Part B premiums is crucial for beneficiaries to effectively plan their healthcare finances. This includes understanding the following:

- Annual Notices: The Centers for Medicare and Medicaid Services (CMS) sends annual notices to beneficiaries outlining the upcoming year’s premium amount. This notice typically arrives in the fall, providing beneficiaries ample time to adjust their financial plans.

- Income-Related Adjustments: Beneficiaries should be aware of the income thresholds that trigger IRMAA and the corresponding premium increases. This knowledge allows them to make informed decisions about their financial planning.

- Potential Changes: Beneficiaries should remain attentive to any announcements regarding potential changes to Medicare Part B coverage or reimbursement rates, as these changes can impact premium costs.

FAQs Regarding Medicare Part B Premiums in 2025

Q: When will the 2025 Medicare Part B premium be announced?

A: The official announcement of the 2025 Medicare Part B premium is typically made in the fall of 2024.

Q: How do I know if my Medicare Part B premium will be affected by IRMAA?

A: The annual Medicare notices will indicate if your premium is subject to IRMAA. You can also find this information on the CMS website.

Q: Can I do anything to lower my Medicare Part B premium?

A: While there are no guarantees, you can consider strategies like exploring income-related adjustments or maximizing your savings to potentially lower your premium.

Q: What happens if I cannot afford to pay my Medicare Part B premium?

A: If you are experiencing financial hardship, you can contact CMS or your local Social Security office to explore options such as a premium assistance program or a payment plan.

Tips for Managing Medicare Part B Premiums

- Budgeting: Create a budget that accounts for your Medicare Part B premiums, allowing for potential annual adjustments.

- Savings: Consider setting aside funds specifically for your Medicare Part B premiums to ensure you have sufficient resources.

- Financial Planning: Consult with a financial advisor to explore strategies for managing your healthcare costs, including Medicare Part B premiums.

- Staying Informed: Stay informed about changes to Medicare Part B premiums and coverage by reviewing annual notices and visiting the CMS website.

Conclusion

Navigating Medicare Part B premiums requires a proactive approach. By understanding the factors that influence these costs, staying informed about upcoming adjustments, and proactively planning your finances, beneficiaries can ensure they have the resources to access the essential medical services covered by Medicare Part B.

![]()

Closure

Thus, we hope this article has provided valuable insights into Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!