Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide

Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide

Medicare Part B, the medical insurance component of the federal health insurance program, covers a wide range of services, including doctor visits, outpatient care, and preventive services. The cost of these services is partially covered by monthly premiums, which are subject to annual adjustments. While the exact 2025 Medicare Part B premium remains to be announced, understanding the factors influencing its determination and the implications of these premiums is crucial for beneficiaries.

Factors Influencing Medicare Part B Premiums:

The annual Medicare Part B premium is not static. It is adjusted each year based on several key factors:

- Projected Costs: The Centers for Medicare & Medicaid Services (CMS) estimates the cost of providing Part B services in the upcoming year. This includes factors like the expected utilization of services, the cost of new medical technologies, and inflation.

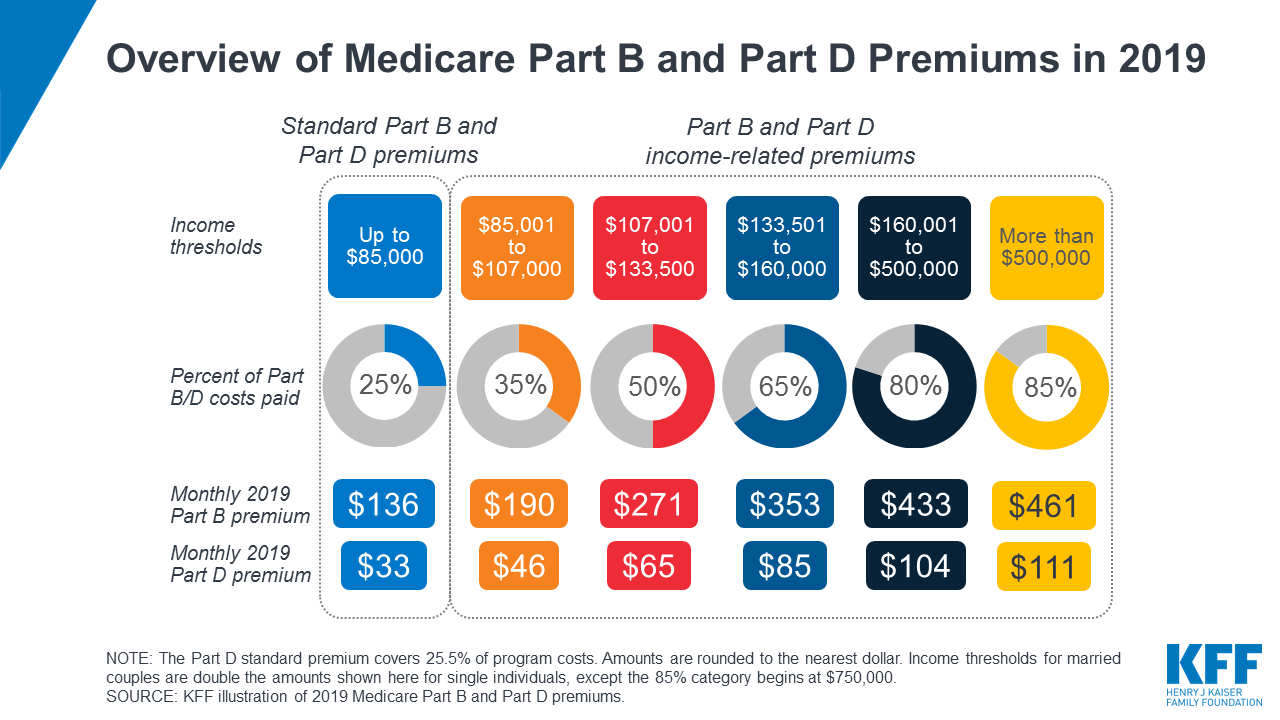

- Income Level: The premium for higher-income beneficiaries is adjusted upwards through a mechanism called the Income-Related Monthly Adjustment Amount (IRMAA). This system aims to ensure that individuals with higher incomes contribute a greater share towards the cost of Medicare.

- Government Funding: The federal government contributes a significant portion towards the cost of Medicare. Changes in government funding can impact the premium burden on beneficiaries.

- Enrollment Trends: Fluctuations in the number of Medicare beneficiaries enrolled in Part B can influence the premium structure.

Understanding the 2025 Premium:

The 2025 Medicare Part B premium will be announced in the fall of 2024, typically in November. This announcement will provide beneficiaries with a clear picture of their monthly cost for Part B coverage in the following year.

Importance of Knowing the Premium:

The Medicare Part B premium plays a vital role in the financial planning of beneficiaries. It is a significant recurring expense that needs to be factored into budgeting and retirement planning.

Benefits of Understanding the Premium:

Understanding the 2025 Medicare Part B premium allows beneficiaries to:

- Budget Effectively: By knowing the premium amount, individuals can plan their finances accordingly, ensuring that they have sufficient funds to cover their healthcare costs.

- Compare Coverage Options: The premium amount can be used as a benchmark when comparing different Medicare Advantage plans, which offer alternative coverage options.

- Explore Cost-Saving Strategies: Beneficiaries can explore strategies like enrolling in a Medicare Savings Program (MSP) or utilizing other cost-saving measures to mitigate the impact of the premium on their finances.

Frequently Asked Questions (FAQs):

Q: How is the 2025 Medicare Part B premium determined?

A: The premium is determined by CMS based on a complex formula that takes into account factors such as the projected cost of providing Part B services, the number of beneficiaries, and government funding levels.

Q: When will the 2025 Medicare Part B premium be announced?

A: The premium is typically announced in November of the year prior to the effective date, so the 2025 premium is expected to be announced in November 2024.

Q: What if I cannot afford the 2025 Medicare Part B premium?

A: There are resources available to help beneficiaries who struggle to afford the premium, such as Medicare Savings Programs (MSPs) and other financial assistance programs.

Q: How can I stay updated on the 2025 Medicare Part B premium?

A: You can stay informed by visiting the official CMS website or subscribing to their email alerts.

Tips for Managing Medicare Part B Premiums:

- Review Your Coverage: Ensure that you are enrolled in the most appropriate Medicare plan for your needs.

- Explore Cost-Saving Measures: Look into programs like Medicare Savings Programs (MSPs) or consider enrolling in a Medicare Advantage plan that may offer lower premiums.

- Budget Wisely: Incorporate the premium amount into your monthly budget to ensure you can afford your healthcare expenses.

- Stay Informed: Keep up-to-date on any changes to Medicare Part B premiums by reviewing official announcements from CMS.

Conclusion:

The 2025 Medicare Part B premium is a crucial factor for beneficiaries to consider when planning their healthcare finances. Understanding the factors that influence its determination and the potential implications for their budget is essential. By staying informed and proactive, beneficiaries can navigate the evolving landscape of Medicare premiums and ensure they have the resources they need to access quality healthcare.

![]()

Closure

Thus, we hope this article has provided valuable insights into Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!