Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide for Individuals Over 65

Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide for Individuals Over 65

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide for Individuals Over 65. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide for Individuals Over 65

Medicare Part B, the medical insurance component of the Medicare program, provides coverage for doctor’s visits, outpatient care, and other medical services. The cost of this coverage is determined by monthly premiums, which are subject to annual adjustments. Understanding these premium changes and how they impact individuals over 65 is crucial for effective financial planning and healthcare access.

Understanding the 2025 Medicare Part B Premium Structure

The Medicare Part B premium for 2025 is currently projected to be $170.10 per month, a slight increase from the 2024 rate. However, this figure is subject to change based on several factors, including:

- The growth of healthcare costs: Inflation and rising healthcare costs directly influence the premium calculations.

- The number of beneficiaries: As the population ages, the number of Medicare beneficiaries increases, potentially impacting premium adjustments.

- Government funding: The federal budget and funding allocated to Medicare play a significant role in premium determination.

Factors Influencing Individual Premiums

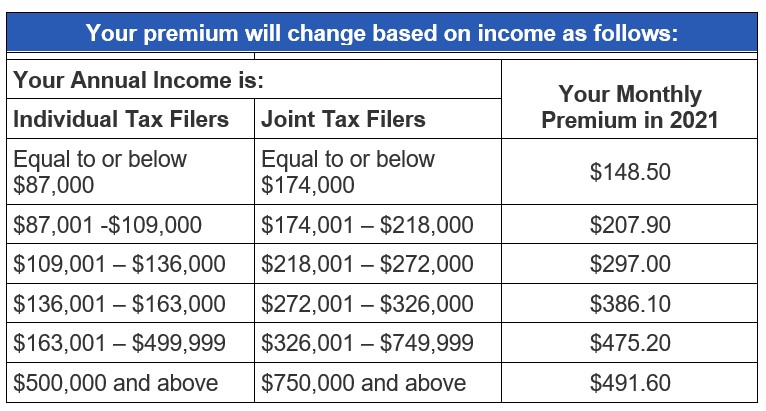

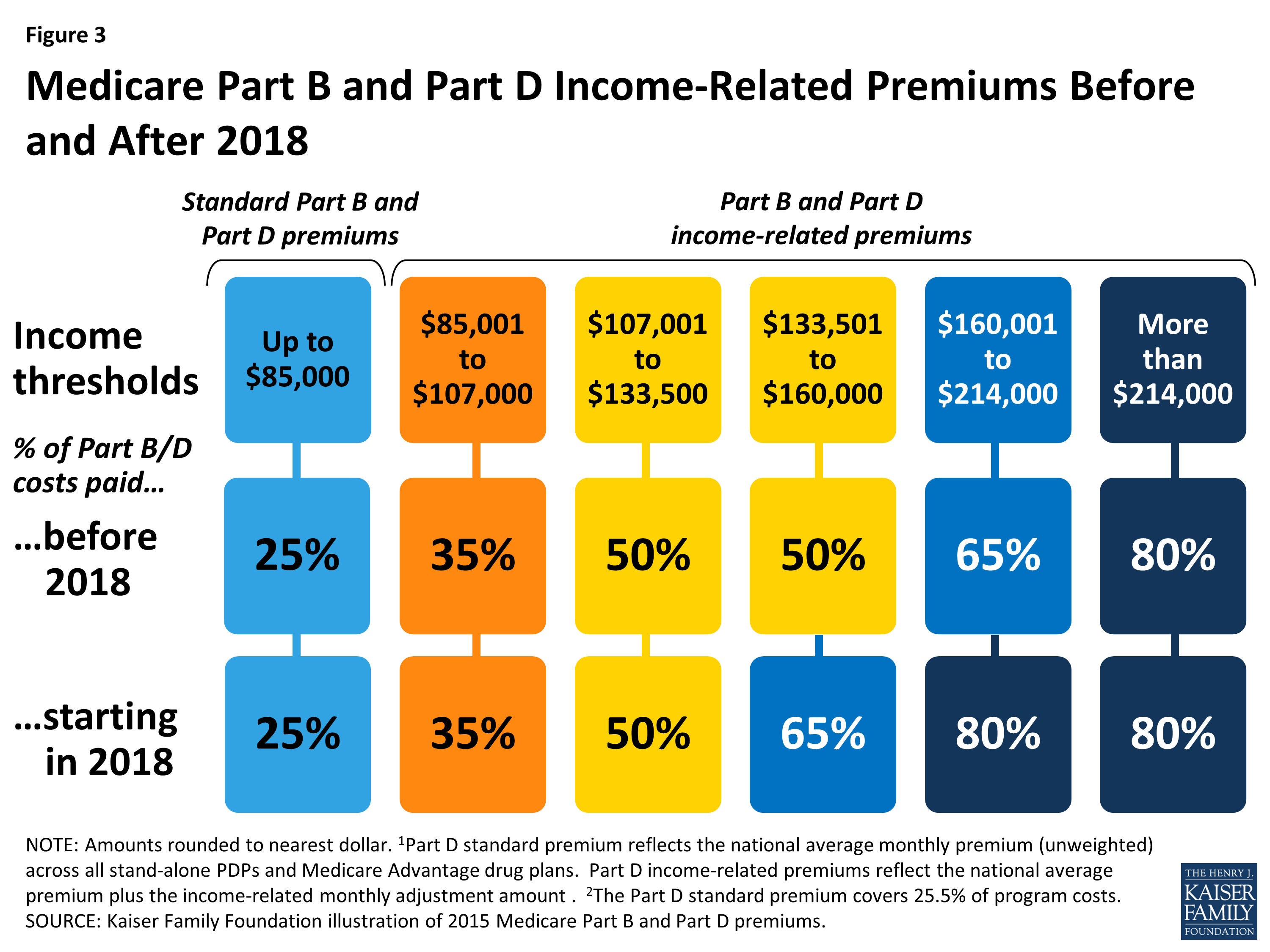

While the standard monthly premium for 2025 is expected to be $170.10, individual premiums can vary based on income levels. For higher-income individuals, the "Income-Related Monthly Adjustment Amount" (IRMAA) comes into play. This additional cost, determined by taxable income, can significantly impact monthly premiums.

IRMAA: Understanding the Income-Based Adjustments

The IRMAA system is designed to ensure that individuals with higher incomes contribute proportionally more towards the cost of Medicare. The higher your adjusted gross income (AGI) on your tax return, the more you will pay in monthly premiums. For 2025, the IRMAA thresholds and corresponding monthly premiums are:

| AGI Range | Monthly Premium |

|---|---|

| $91,000 – $114,000 (single) / $182,000 – $228,000 (married) | $250.10 |

| $114,000 – $135,000 (single) / $228,000 – $270,000 (married) | $325.10 |

| $135,000 – $160,000 (single) / $270,000 – $320,000 (married) | $400.10 |

| $160,000+ (single) / $320,000+ (married) | $500.10 |

Navigating Medicare Part B Premium Changes: Key Considerations

For individuals over 65, staying informed about Medicare Part B premium changes is essential. These adjustments can impact your monthly budget and healthcare planning. Here are some key points to consider:

- Proactive planning: Stay informed about annual premium updates and potential IRMAA implications.

- Budgeting: Factor in the projected premium costs when planning your monthly expenses.

- Exploring options: If the standard premium or IRMAA adjustments pose a financial burden, consider exploring options like Medicare Savings Programs or enrolling in a Medicare Advantage plan.

Frequently Asked Questions (FAQs)

1. How are Medicare Part B premiums determined?

The premiums are calculated based on the projected costs of providing Medicare benefits, including medical services, administrative expenses, and other program expenditures.

2. When are Medicare Part B premiums due?

Premiums are typically deducted from Social Security benefits or paid through other methods, depending on your enrollment status.

3. What happens if I can’t afford the Medicare Part B premium?

If you have limited income and resources, you may be eligible for a Medicare Savings Program that helps pay for premiums, deductibles, and coinsurance.

4. Can I change my Medicare Part B coverage?

You can typically enroll in, change, or drop Medicare Part B during the Annual Enrollment Period (AEP), which runs from October 15 to December 7 each year.

5. What are the consequences of not paying my Medicare Part B premium?

If you fail to pay your premiums, your Medicare coverage may be terminated, and you may face penalties upon re-enrollment.

Tips for Managing Medicare Part B Premiums

- Review your Medicare Summary Notice: This document outlines your coverage and premium details, helping you understand your costs.

- Consider Medicare Advantage plans: These plans often include prescription drug coverage and may offer lower premiums compared to Original Medicare.

- Contact your local Social Security office or Medicare helpline: Seek assistance with understanding your premium obligations and potential financial assistance programs.

Conclusion

Medicare Part B premiums are an essential component of healthcare costs for individuals over 65. Understanding the factors influencing premium adjustments, exploring potential financial assistance options, and engaging in proactive planning can ensure access to necessary medical services while managing financial implications effectively. Staying informed and seeking professional guidance can empower individuals to navigate the complexities of Medicare Part B and secure the healthcare they need.

Closure

Thus, we hope this article has provided valuable insights into Navigating Medicare Part B Premiums in 2025: A Comprehensive Guide for Individuals Over 65. We hope you find this article informative and beneficial. See you in our next article!