Navigating Medicare Parts A & B in 2025: Understanding Premiums and Deductibles

Navigating Medicare Parts A & B in 2025: Understanding Premiums and Deductibles

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Medicare Parts A & B in 2025: Understanding Premiums and Deductibles. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Medicare Parts A & B in 2025: Understanding Premiums and Deductibles

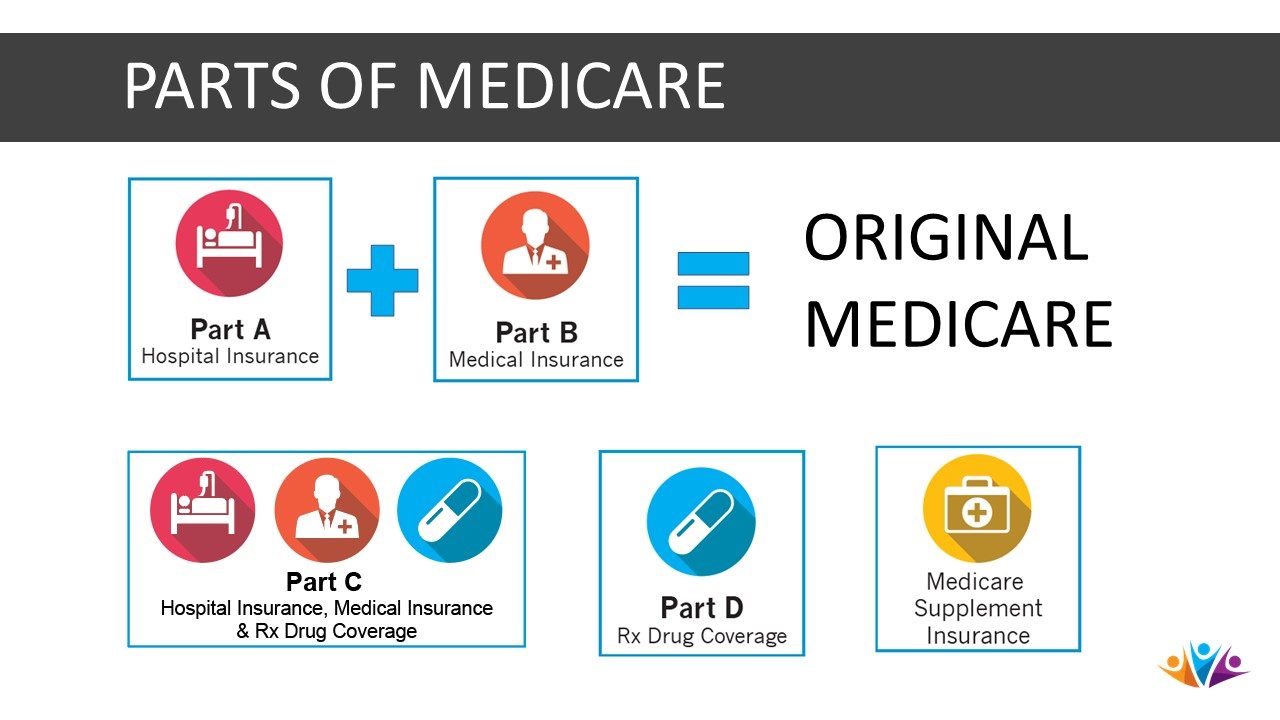

As individuals approach retirement age, understanding the intricacies of Medicare becomes paramount. Medicare, the federal health insurance program for those 65 and older, offers two core components: Part A, covering hospital stays, and Part B, covering doctor’s visits, outpatient care, and preventive services. Both parts require financial contributions from beneficiaries, known as premiums and deductibles.

The cost of Medicare Parts A and B, including premiums and deductibles, is subject to annual adjustments based on factors such as inflation, healthcare costs, and program utilization. While exact figures for 2025 are not yet available, analyzing historical trends and current projections provides valuable insights into potential changes.

Understanding Premiums and Deductibles

- Premiums: These are monthly payments made to Medicare for coverage. For Part A, most individuals do not pay a premium as they have already contributed through payroll taxes during their working years. However, some individuals may be required to pay a premium based on their earnings history. Part B premiums are generally paid by all beneficiaries.

- Deductibles: These are fixed amounts that beneficiaries pay out-of-pocket before Medicare begins to cover healthcare costs. Both Part A and Part B have deductibles, which reset annually.

Factors Influencing 2025 Premiums and Deductibles

Several factors contribute to the annual adjustments in Medicare premiums and deductibles.

- Inflation: The rate of inflation plays a significant role in determining the annual cost-of-living adjustment (COLA) for Social Security benefits, which directly impacts Medicare premiums.

- Healthcare Costs: Rising healthcare costs, driven by factors such as technological advancements, prescription drug prices, and administrative expenses, can influence Medicare premiums and deductibles.

- Program Utilization: Higher utilization of Medicare benefits, such as increased hospital admissions or outpatient visits, can lead to higher premiums and deductibles.

- Government Budget: The federal budget and its allocation towards Medicare can also impact the cost of premiums and deductibles.

Potential 2025 Changes

While specific figures are not yet available, projections based on historical trends and current economic conditions suggest potential changes for 2025.

- Increased Premiums: Inflation and rising healthcare costs are likely to contribute to an increase in Medicare premiums.

- Higher Deductibles: Deductibles for both Part A and Part B may also increase, potentially requiring beneficiaries to pay more out-of-pocket before Medicare coverage kicks in.

- Impact on Beneficiaries: These potential changes could impact beneficiaries’ out-of-pocket healthcare expenses, potentially leading to increased financial burdens.

Navigating the Changes

Understanding potential changes in Medicare premiums and deductibles is crucial for beneficiaries to effectively plan their finances.

- Stay Informed: Keep abreast of official announcements from the Centers for Medicare and Medicaid Services (CMS) regarding annual adjustments and potential changes.

- Budgeting: Factor in potential increases in premiums and deductibles when planning your retirement budget.

- Explore Options: Consider options like Medicare Advantage plans, which offer additional benefits and may have lower premiums compared to traditional Medicare.

- Seek Professional Guidance: Consult with a financial advisor or insurance broker to discuss your individual needs and explore strategies for managing healthcare costs.

Frequently Asked Questions

Q: How can I find out the exact premiums and deductibles for 2025?

A: The official announcements for Medicare premiums and deductibles for 2025 will be released by the Centers for Medicare and Medicaid Services (CMS) typically in the fall of 2024.

Q: What if I cannot afford the increased premiums or deductibles?

A: If you are facing financial difficulties, contact the Social Security Administration or your state’s health insurance marketplace for assistance.

Q: Can I choose to pay a higher premium to avoid a deductible?

A: No, Medicare premiums and deductibles are separate and cannot be adjusted to avoid paying either.

Tips for Managing Costs

- Preventive Care: Take advantage of preventive services covered by Medicare, such as annual checkups, screenings, and vaccinations, to potentially avoid more expensive treatments later.

- Shop Around: Compare prices for prescription drugs and medical services to find the best value.

- Consider a Medicare Advantage Plan: Explore Medicare Advantage plans, which may offer additional benefits and lower premiums compared to traditional Medicare.

- Enroll in a Medicare Savings Program: If you have limited income and resources, you may be eligible for a Medicare Savings Program that helps pay for premiums, deductibles, and copayments.

Conclusion

Understanding Medicare Parts A and B premiums and deductibles is vital for individuals nearing retirement. By staying informed about potential changes, planning your budget, and exploring available resources, you can navigate the complexities of Medicare and ensure access to quality healthcare in the years to come. Remember to consult with professionals for personalized guidance and to stay informed about the latest updates from CMS.

![]()

Closure

Thus, we hope this article has provided valuable insights into Navigating Medicare Parts A & B in 2025: Understanding Premiums and Deductibles. We hope you find this article informative and beneficial. See you in our next article!