Navigating the 2025 Medicare Part B Premium Landscape: A Comprehensive Guide for Seniors

Navigating the 2025 Medicare Part B Premium Landscape: A Comprehensive Guide for Seniors

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the 2025 Medicare Part B Premium Landscape: A Comprehensive Guide for Seniors. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Medicare Part B Premium Landscape: A Comprehensive Guide for Seniors

Medicare Part B, the government-funded program providing outpatient medical coverage for seniors over 65, is a vital component of healthcare security for millions of Americans. However, understanding the nuances of Part B premiums, particularly the potential for increases, is crucial for beneficiaries to effectively manage their healthcare costs. This article aims to provide a comprehensive overview of the factors influencing Part B premiums in 2025, the potential for increases, and strategies for navigating these changes.

Factors Influencing Medicare Part B Premiums

Several key factors contribute to the annual determination of Medicare Part B premiums. These include:

- The Cost of Covered Services: The rising costs of medical services, treatments, and medications are directly reflected in the premiums. As healthcare inflation continues, the cost of providing these services increases, necessitating adjustments in premium contributions.

- Enrollment Trends: The number of individuals enrolled in Medicare Part B impacts the overall cost of the program. As the population ages and more individuals become eligible for Medicare, the program’s financial burden can increase, potentially leading to higher premiums.

- Government Spending: Federal spending patterns and budget allocations directly influence the funding available for Medicare. Cuts or reductions in government funding can necessitate increases in premiums to maintain the program’s stability.

- Program Administration Costs: The cost of administering Medicare, including processing claims, managing enrollment, and providing customer service, is factored into the premium calculation. Efficiency improvements and streamlined processes can help mitigate these costs, but they are still a contributing factor.

Potential for Increases in 2025

While precise figures for 2025 Medicare Part B premiums are not yet available, several factors suggest the potential for increases:

- Inflationary Pressures: The ongoing inflation in the US economy has pushed up the cost of medical services and supplies, impacting the overall cost of providing healthcare. This inflationary pressure is likely to translate into higher premiums for Medicare Part B in 2025.

- Increased Demand for Healthcare: The aging population and rising rates of chronic diseases are increasing the demand for healthcare services, putting further pressure on Medicare’s finances. This increased demand could contribute to higher premiums.

- Congressional Budgetary Considerations: The ongoing debate over federal spending and the potential for cuts to Medicare funding could necessitate higher premiums to maintain the program’s solvency.

Strategies for Navigating Potential Premium Increases

While the exact magnitude of any premium increases is uncertain, beneficiaries can take proactive steps to mitigate the potential financial impact:

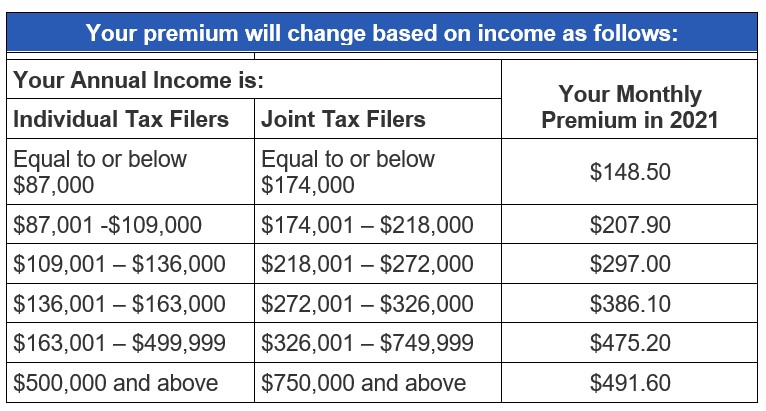

- Review Your Income: Medicare Part B premiums are income-based, with higher-income beneficiaries paying a higher premium. Review your income and explore any potential deductions or adjustments that could lower your premium burden.

- Explore Alternative Healthcare Options: Consider exploring other healthcare options, such as Medicare Advantage plans, which may offer lower premiums and additional benefits. However, it is crucial to carefully compare plans and coverage to ensure they meet your specific healthcare needs.

- Maximize Your Savings: Begin planning for potential premium increases by maximizing your savings and exploring investment strategies that can help you manage future healthcare expenses.

- Stay Informed: Keep abreast of any updates or announcements regarding Medicare Part B premiums. The Centers for Medicare & Medicaid Services (CMS) regularly publishes information about premium changes and other program updates.

FAQs: 2025 Medicare Part B Premium Increase

Q: When will the 2025 Medicare Part B premiums be announced?

A: The official announcement of Medicare Part B premiums for 2025 is typically made in the fall of the preceding year. CMS typically releases this information in October or November, providing beneficiaries with sufficient time to prepare for any changes.

Q: How will I be notified of any premium increases?

A: CMS will notify beneficiaries of any premium increases through official mailings, website updates, and other communication channels. It is crucial to ensure your contact information is up-to-date with CMS to receive these notifications.

Q: What if I cannot afford the increased premium?

A: If you are struggling to afford the increased premium, you can contact CMS or your local Medicare office for assistance. There may be programs or resources available to help individuals who are facing financial hardship due to rising premiums.

Q: Can I appeal a premium increase?

A: While you cannot directly appeal the premium increase itself, you can challenge any errors or discrepancies in the calculation of your premium. If you believe your premium is incorrect, contact CMS or your local Medicare office to initiate a review.

Tips for Managing Medicare Part B Premiums

- Enroll in Medicare Part B promptly: Enroll in Part B as soon as you are eligible to avoid potential penalties and ensure continuous coverage.

- Avoid unnecessary medical services: Review your medical needs and prioritize essential services to minimize unnecessary healthcare spending.

- Explore prescription drug discounts: Look for discounts on prescription medications through programs like Medicare Part D or manufacturer coupons.

- Utilize preventive services: Take advantage of preventive services covered by Medicare Part B, such as screenings and vaccinations, to prevent costly health complications.

Conclusion

Navigating the complexities of Medicare Part B premiums, particularly in light of potential increases, requires careful planning and informed decision-making. By understanding the factors influencing premiums, exploring strategies to mitigate financial impact, and staying informed about program updates, seniors can effectively manage their healthcare costs and maintain access to essential medical services. Proactive engagement with the Medicare system empowers beneficiaries to make informed choices and secure their healthcare future.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Medicare Part B Premium Landscape: A Comprehensive Guide for Seniors. We thank you for taking the time to read this article. See you in our next article!