Navigating the 2025 Medicare Part B Premium Landscape: A Guide for Seniors

Navigating the 2025 Medicare Part B Premium Landscape: A Guide for Seniors

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the 2025 Medicare Part B Premium Landscape: A Guide for Seniors. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Medicare Part B Premium Landscape: A Guide for Seniors

The cost of healthcare continues to be a significant concern for many Americans, particularly seniors. Medicare Part B, which covers doctor’s visits, outpatient care, and other medical services, plays a crucial role in ensuring access to quality care. Understanding the nuances of Part B premiums is essential for seniors seeking to budget effectively and make informed decisions regarding their healthcare coverage.

Understanding the 2025 Medicare Part B Premium Calculation

The Medicare Part B premium for 2025 is determined by a complex formula that takes into account several factors:

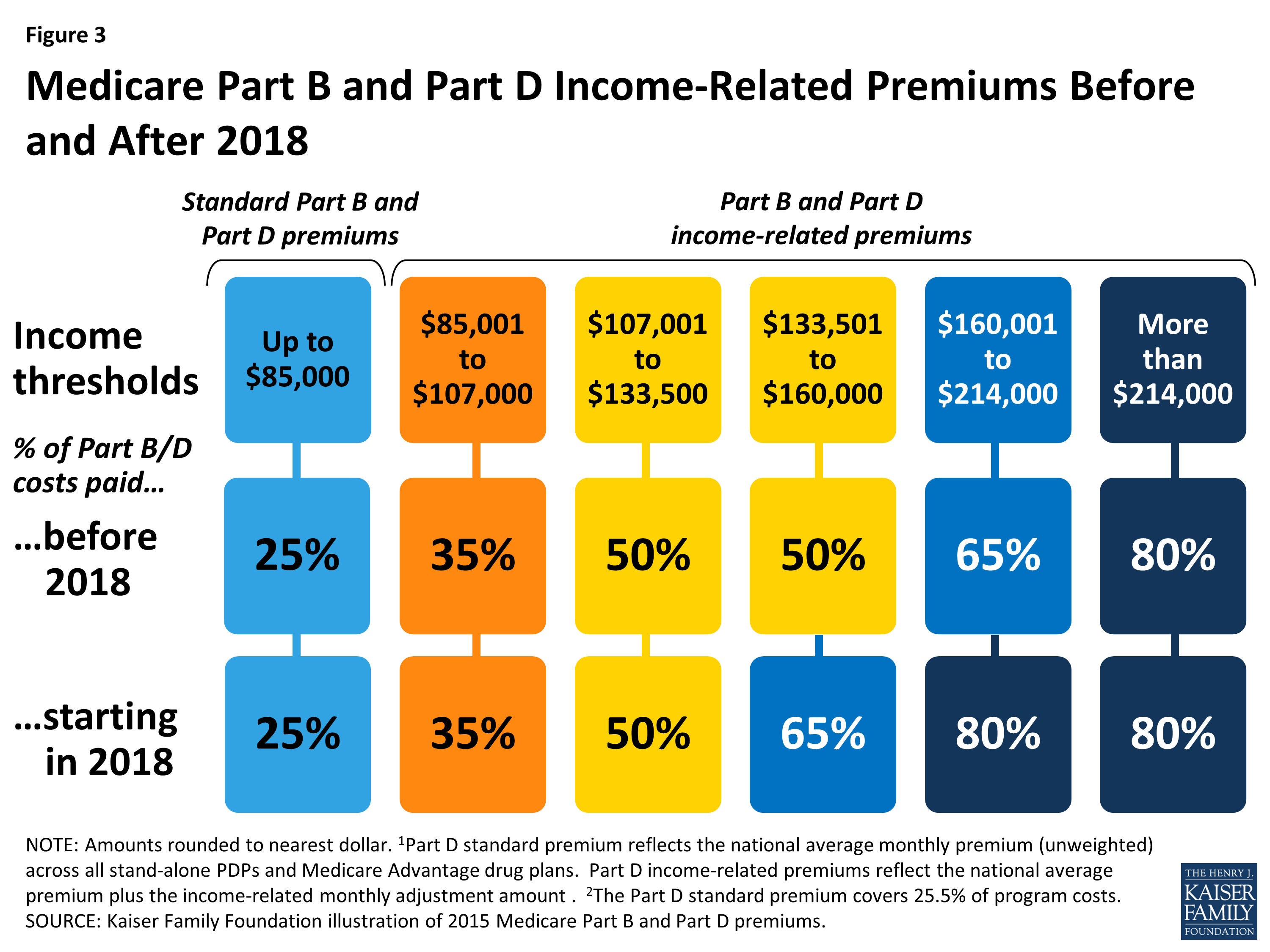

- Income: Individuals with higher incomes are generally subject to higher premiums. This is known as the "Income-Related Monthly Adjustment Amount" (IRMAA).

- Cost of Medical Services: Fluctuations in the cost of medical services, such as physician fees and prescription drugs, can impact the overall premium.

- Government Funding: The federal government contributes a substantial portion to the Medicare program. Changes in government funding can influence the level of premiums.

- Enrollment Trends: The number of individuals enrolling in Medicare Part B can also affect premiums.

Projected 2025 Medicare Part B Premiums

While exact figures for 2025 premiums are not yet available, it’s important to note that premiums tend to increase annually. This trend is driven by rising healthcare costs and other factors mentioned above.

Factors Affecting Premium Increases

- Aging Population: The increasing number of seniors in the United States puts pressure on healthcare resources, contributing to rising costs.

- Technological Advancements: New medical technologies and treatments often come with higher price tags, impacting overall healthcare spending.

- Inflation: General inflation affects the cost of goods and services, including medical care, which can lead to premium increases.

Importance of Understanding 2025 Medicare Part B Premiums

Understanding the factors influencing Medicare Part B premiums allows seniors to:

- Plan for Future Healthcare Costs: By anticipating potential premium increases, seniors can adjust their budgets and financial plans accordingly.

- Make Informed Decisions about Supplemental Coverage: Knowing the cost of Part B can help seniors determine whether additional coverage, such as Medigap or Medicare Advantage, is necessary.

- Advocate for Policy Changes: Understanding the drivers of premium increases can empower seniors to advocate for policies that address rising healthcare costs.

Navigating the 2025 Medicare Part B Premium Landscape: Tips for Seniors

- Review Your Medicare Enrollment: Verify your current Medicare coverage and ensure you are enrolled in the appropriate plans.

- Monitor Your Income: Changes in income can impact your Part B premium. Stay informed about potential income-related adjustments.

- Explore Medicare Advantage Plans: Consider exploring Medicare Advantage plans, which may offer lower premiums and additional benefits.

- Seek Professional Guidance: Consult with a Medicare specialist or financial advisor to discuss your specific circumstances and explore options for managing your healthcare costs.

Frequently Asked Questions About 2025 Medicare Part B Premiums

Q: When will the 2025 Medicare Part B premiums be announced?

A: The Centers for Medicare & Medicaid Services (CMS) typically announces Part B premiums for the upcoming year in the fall of the previous year.

Q: How can I estimate my 2025 Medicare Part B premium?

A: The CMS website provides an online tool that allows you to estimate your premium based on your income and other factors.

Q: What happens if I cannot afford my Medicare Part B premium?

A: If you are struggling to afford your Medicare Part B premium, you may be eligible for financial assistance programs. Contact your local Social Security office or the CMS for information.

Q: What are the potential consequences of not paying my Medicare Part B premium?

A: Failure to pay your Medicare Part B premium can result in the suspension of your coverage.

Conclusion

Understanding the factors that influence Medicare Part B premiums is crucial for seniors seeking to navigate the complexities of healthcare financing. By staying informed about the potential for premium increases and exploring available options, seniors can make informed decisions to ensure access to quality medical care while managing their healthcare costs effectively.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Medicare Part B Premium Landscape: A Guide for Seniors. We hope you find this article informative and beneficial. See you in our next article!