Navigating the 2025 Medicare Part B Premium Landscape: A Guide for Seniors

Navigating the 2025 Medicare Part B Premium Landscape: A Guide for Seniors

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the 2025 Medicare Part B Premium Landscape: A Guide for Seniors. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Medicare Part B Premium Landscape: A Guide for Seniors

Medicare Part B, which covers outpatient medical services, is a vital component of healthcare for millions of seniors. However, understanding the annual premium adjustments can be a complex process. This article provides a comprehensive overview of the 2025 Medicare Part B premium increase chart, its significance, and how it impacts beneficiaries.

Understanding the 2025 Medicare Part B Premium Increase Chart

The Medicare Part B premium is determined annually by the Centers for Medicare & Medicaid Services (CMS) based on several factors, including:

- Projected healthcare costs: The rising cost of healthcare services directly impacts the premium.

- Enrollment trends: Changes in the number of beneficiaries enrolled in Part B influence the overall cost burden.

- Economic factors: Inflation and other economic indicators play a role in adjusting premiums.

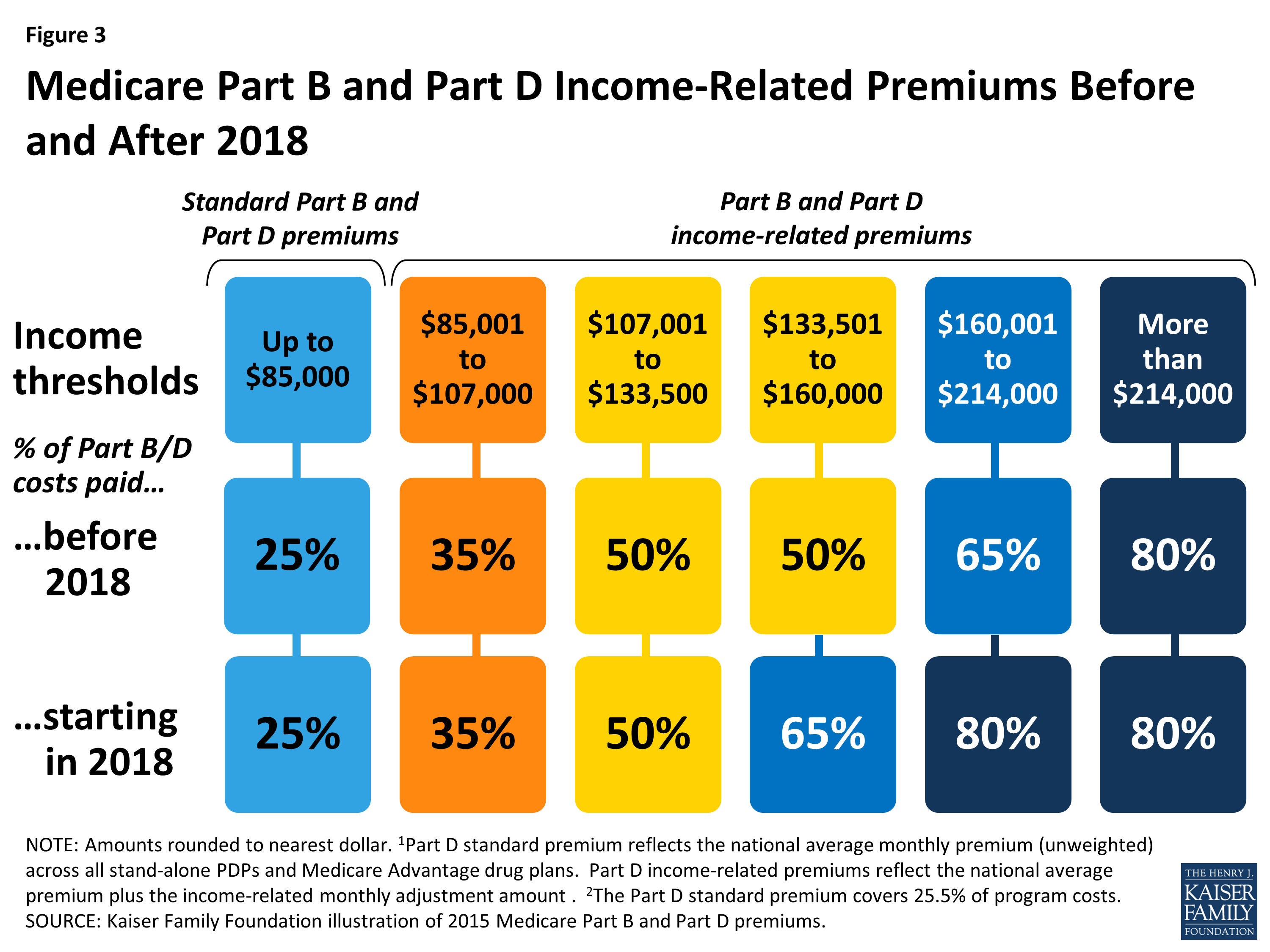

The 2025 Medicare Part B premium increase chart, typically released in the fall of the preceding year, outlines the anticipated monthly premium amounts for the upcoming year. It categorizes beneficiaries based on their income levels, with higher-income individuals paying a higher premium. This tiered structure, known as the Income-Related Monthly Adjustment Amount (IRMAA), ensures that higher-income beneficiaries contribute proportionally more to the program’s costs.

The Importance of the Premium Increase Chart

The 2025 Medicare Part B premium increase chart serves as a critical tool for beneficiaries to:

- Plan for healthcare expenses: By understanding the anticipated premium, beneficiaries can budget accordingly and ensure they have sufficient financial resources to cover their healthcare needs.

- Compare coverage options: The chart provides a clear picture of the financial implications of different Medicare Part B options, allowing beneficiaries to choose the plan that best suits their budget and health needs.

- Advocate for policy changes: The chart highlights the financial burden associated with healthcare costs, encouraging beneficiaries to engage in discussions and advocate for policies that address rising premiums and ensure the long-term sustainability of Medicare.

Navigating the Chart: Key Considerations

When reviewing the 2025 Medicare Part B premium increase chart, several key considerations are crucial:

- Income thresholds: Understand the income brackets that trigger the IRMAA and the corresponding premium adjustments.

- Premium changes: Analyze the percentage increase in premiums compared to the previous year and its impact on your budget.

- Additional costs: Be aware of potential out-of-pocket expenses, such as deductibles and coinsurance, in addition to the premium.

- Enrollment deadlines: Familiarize yourself with the enrollment periods and deadlines to avoid any penalties or coverage gaps.

FAQs about the 2025 Medicare Part B Premium Increase Chart

Q: How can I access the 2025 Medicare Part B premium increase chart?

A: The chart will be published on the CMS website in the fall of 2024. You can also obtain information from your Medicare insurance provider or a Medicare-certified insurance agent.

Q: What if I cannot afford the increased premium?

A: If you are struggling to afford the premium, you may be eligible for financial assistance programs or subsidies. Contact the Social Security Administration or your state’s health insurance marketplace for information.

Q: How often are Medicare Part B premiums adjusted?

A: Premiums are adjusted annually, typically in the fall of each year, based on projected healthcare costs and other factors.

Q: What factors influence the premium increase?

A: The premium increase is influenced by factors such as projected healthcare costs, enrollment trends, economic conditions, and the cost of administering the program.

Tips for Managing Medicare Part B Premiums

- Consider enrolling in a Medicare Advantage plan: These plans may offer lower premiums and additional benefits compared to traditional Medicare.

- Explore Medicare Savings Programs: If you have limited income, you may qualify for programs that help reduce your premium costs.

- Shop around for supplemental insurance: A Medigap policy can help cover out-of-pocket expenses and protect you from unexpected costs.

- Stay informed about changes: Keep up-to-date on any changes to Medicare Part B, including premium adjustments, by visiting the CMS website or contacting your insurance provider.

Conclusion

The 2025 Medicare Part B premium increase chart will provide essential information for seniors navigating the complex world of Medicare. Understanding the chart’s implications, exploring available options, and seeking guidance from qualified professionals can help beneficiaries make informed decisions regarding their healthcare coverage and ensure they receive the care they need. As healthcare costs continue to rise, staying informed and proactive about Medicare Part B premiums is crucial for maintaining financial stability and accessing quality healthcare in the years to come.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Medicare Part B Premium Landscape: A Guide for Seniors. We appreciate your attention to our article. See you in our next article!