Navigating the 2025 Medicare Part D Landscape: Understanding the Changes and Their Impact

Navigating the 2025 Medicare Part D Landscape: Understanding the Changes and Their Impact

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the 2025 Medicare Part D Landscape: Understanding the Changes and Their Impact. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Medicare Part D Landscape: Understanding the Changes and Their Impact

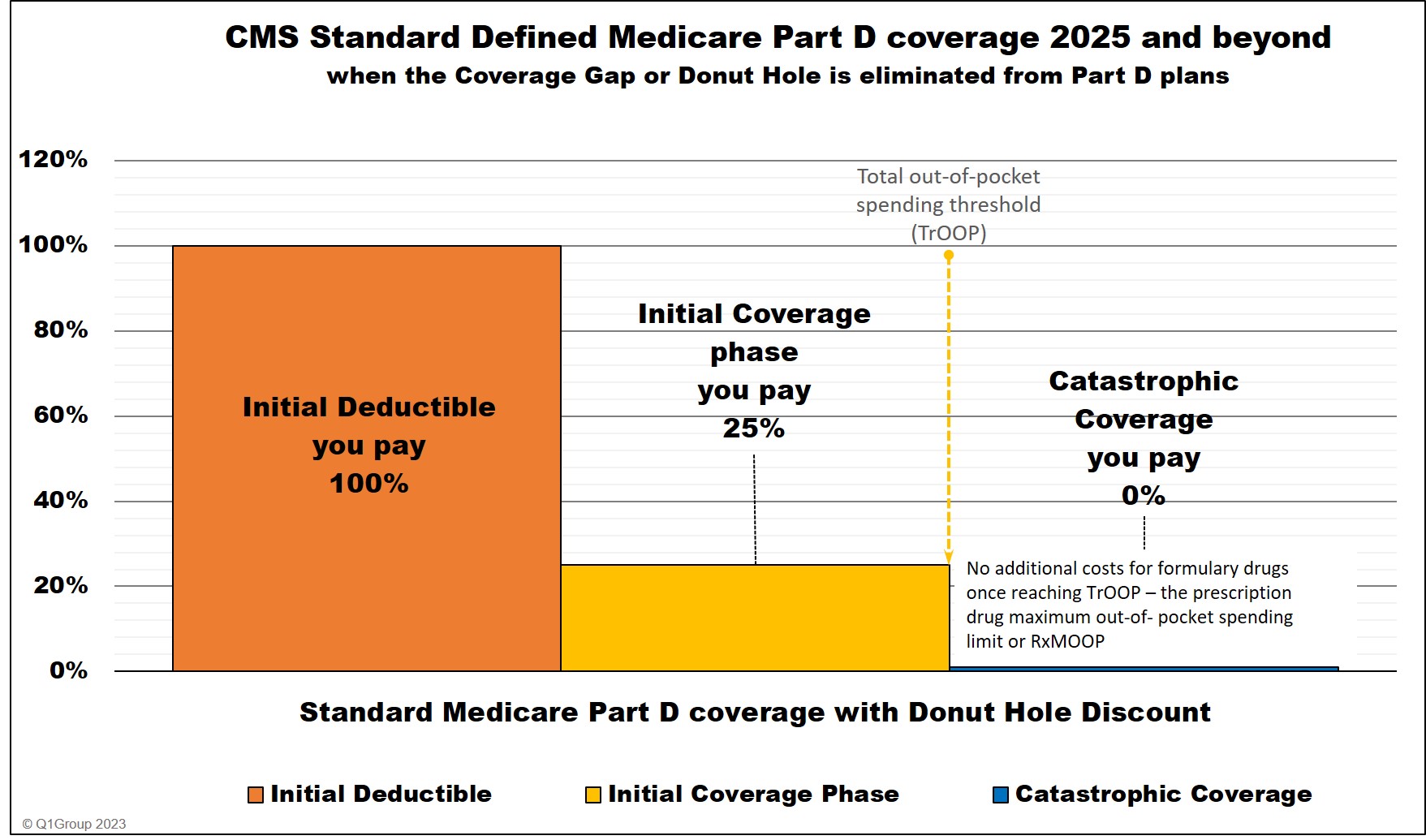

The Medicare Part D program, offering prescription drug coverage to millions of Americans, is undergoing a significant transformation in 2025. These changes, driven by the Centers for Medicare & Medicaid Services (CMS), aim to improve the program’s efficiency, affordability, and accessibility. This article will delve into the key changes, their potential impact on beneficiaries, and provide guidance for navigating the evolving landscape.

1. The New "Maximum Out-of-Pocket" Limit:

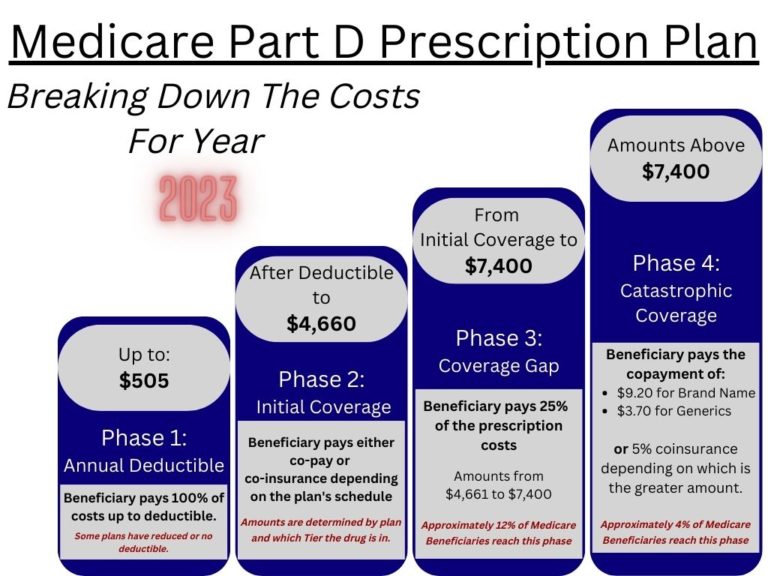

One of the most notable changes in 2025 is the introduction of a new maximum out-of-pocket limit for Medicare Part D beneficiaries. This limit, currently set at $7,050 in 2023, will be capped at a lower threshold, effectively lowering the maximum amount a beneficiary will have to pay for their prescription drugs in a given year. This change aims to protect beneficiaries from exorbitant drug costs and provide greater financial security.

2. Enhanced Coverage for Insulin:

Recognizing the high cost of insulin and its vital role in managing diabetes, CMS is implementing changes to enhance coverage for this essential medication. In 2025, Part D plans will be required to offer a lower copayment for insulin, making it more affordable for beneficiaries with diabetes. This change is expected to significantly reduce the financial burden associated with insulin for many individuals.

3. Strengthening the Medicare Part D "Donut Hole":

The "Donut Hole," the coverage gap in Part D where beneficiaries pay a higher percentage of their drug costs, is also undergoing adjustments in 2025. The coverage gap will be reduced, meaning beneficiaries will reach the point where they receive significant discounts on their drug costs sooner than before. This adjustment will help mitigate the financial burden associated with the coverage gap and provide greater relief to beneficiaries.

4. Increased Transparency and Plan Comparisons:

To empower beneficiaries to make informed decisions about their Part D plan choices, CMS is implementing initiatives to enhance transparency and facilitate plan comparisons. In 2025, plan information will be presented in a clearer and more user-friendly format, allowing beneficiaries to easily compare plans based on their specific needs and preferences. This increased transparency will help beneficiaries select the plan that best meets their individual circumstances.

5. Expanded Access to Low-Income Subsidies:

The Low-Income Subsidy (LIS) program, which provides financial assistance to low-income beneficiaries for Part D coverage, is expanding in 2025. This expansion will make it easier for individuals with limited financial resources to access affordable prescription drug coverage. The changes aim to ensure that all beneficiaries, regardless of their income level, have access to the essential medications they need.

Impact on Beneficiaries:

These changes are expected to have a significant impact on Medicare Part D beneficiaries:

- Lower Out-of-Pocket Costs: The new maximum out-of-pocket limit and enhanced coverage for insulin will directly reduce the amount beneficiaries pay for their medications, improving affordability and financial stability.

- Improved Access to Medications: The changes to the Donut Hole and the expansion of the LIS program will increase access to essential medications, particularly for those with chronic conditions or limited financial resources.

- Greater Transparency and Choice: Enhanced transparency and plan comparison tools will empower beneficiaries to make informed choices about their Part D plan, ensuring they select the plan that best meets their individual needs.

FAQs by 2025 Medicare Part D Changes:

1. Will these changes affect my current Part D plan?

The changes will affect all Part D plans offered in 2025. However, the specific impact on your current plan will depend on the plan’s design and the specific changes implemented. It’s essential to review your plan’s details and compare it to other plans available in your area to understand the potential impact on your costs and coverage.

2. How will these changes affect my monthly premium?

The impact on your monthly premium will depend on the specific plan you choose and the changes implemented by CMS. Some plans may see adjustments in their premiums as a result of these changes. It’s crucial to carefully review the premium information for all plans available in your area and compare them based on your specific needs and budget.

3. When will these changes take effect?

The changes are scheduled to take effect on January 1, 2025. It’s essential to stay informed about the changes and their impact on your plan well in advance of the effective date to ensure a smooth transition.

4. What resources are available to help me understand these changes?

CMS offers a wealth of resources to help beneficiaries understand the changes and their impact on their coverage. The Medicare website, Medicare publications, and the Medicare helpline (1-800-MEDICARE) are valuable sources of information. You can also contact your local Area Agency on Aging or the State Health Insurance Assistance Program (SHIP) for personalized assistance.

Tips by 2025 Medicare Part D Changes:

1. Stay Informed: Keep up-to-date on the changes and their potential impact on your coverage by reviewing Medicare publications, attending informational sessions, and contacting your local SHIP or Area Agency on Aging.

2. Review Your Plan: Carefully review your current Part D plan and compare it to other plans available in your area to identify the best option based on your specific needs and budget.

3. Utilize Comparison Tools: Use the Medicare Plan Finder and other online comparison tools to easily compare plans based on cost, coverage, and formulary.

4. Seek Assistance: Don’t hesitate to contact the Medicare helpline, your local SHIP, or your Area Agency on Aging for personalized guidance and support in navigating the changes.

Conclusion by 2025 Medicare Part D Changes:

The 2025 changes to Medicare Part D represent a significant step towards improving the program’s efficiency, affordability, and accessibility. By lowering out-of-pocket costs, enhancing coverage for essential medications, and increasing transparency, these changes aim to provide greater financial security and access to care for beneficiaries. By staying informed, reviewing your plan, and seeking assistance when needed, you can navigate the evolving landscape of Medicare Part D and ensure you receive the coverage you need.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Medicare Part D Landscape: Understanding the Changes and Their Impact. We hope you find this article informative and beneficial. See you in our next article!