Navigating the Future of Medicare Part B: Understanding the 2025 Premium Estimate

Navigating the Future of Medicare Part B: Understanding the 2025 Premium Estimate

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future of Medicare Part B: Understanding the 2025 Premium Estimate. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future of Medicare Part B: Understanding the 2025 Premium Estimate

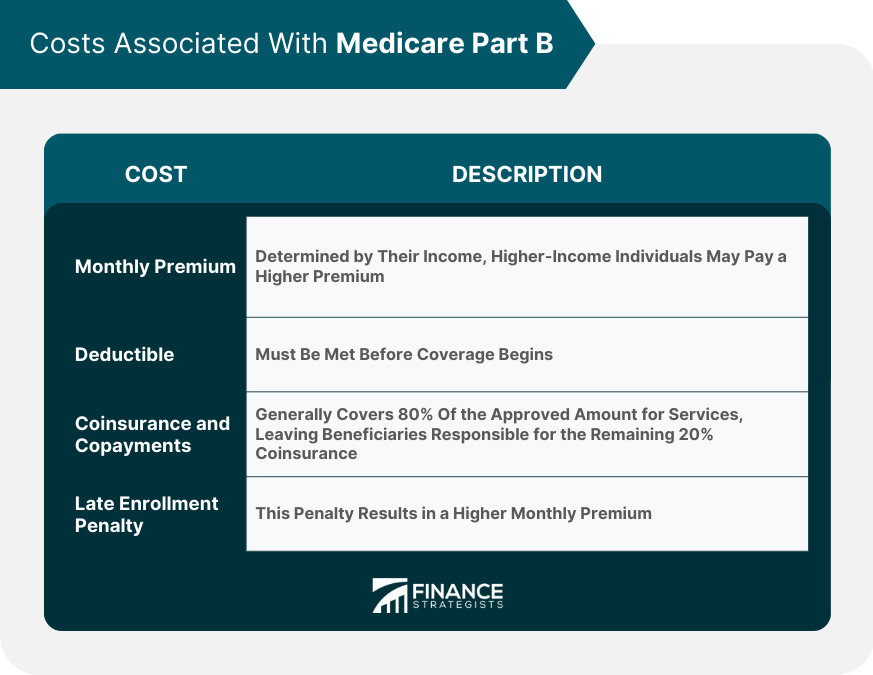

Medicare Part B, the insurance program covering physician services, outpatient care, and other medical services, is a crucial component of healthcare for millions of Americans. As we look towards 2025, understanding the projected changes in Part B premiums becomes essential for individuals planning their retirement finances and healthcare strategies.

Factors Influencing the 2025 Medicare Part B Premium

The annual Medicare Part B premium is determined by a complex interplay of factors, including:

- Projected Healthcare Costs: The rising cost of healthcare services, driven by advancements in medical technology, aging demographics, and increasing demand, directly impacts the premium.

- Utilization Rates: The frequency and intensity of healthcare services used by Medicare beneficiaries influence the overall cost of the program, which in turn affects the premium.

- Government Spending and Budgetary Constraints: Government spending on Medicare, influenced by political and economic factors, can impact the premium structure.

- Inflation: The general rate of inflation impacts the cost of healthcare services, potentially leading to higher premiums.

- Changes in Medicare Policy: Policy decisions made by Congress and the Centers for Medicare and Medicaid Services (CMS) can influence the premium structure.

Understanding the 2025 Premium Estimate

While the exact 2025 Medicare Part B premium remains uncertain, the current projections offer valuable insights. It is important to note that these estimates are subject to change based on evolving economic and healthcare trends.

Current Projections:

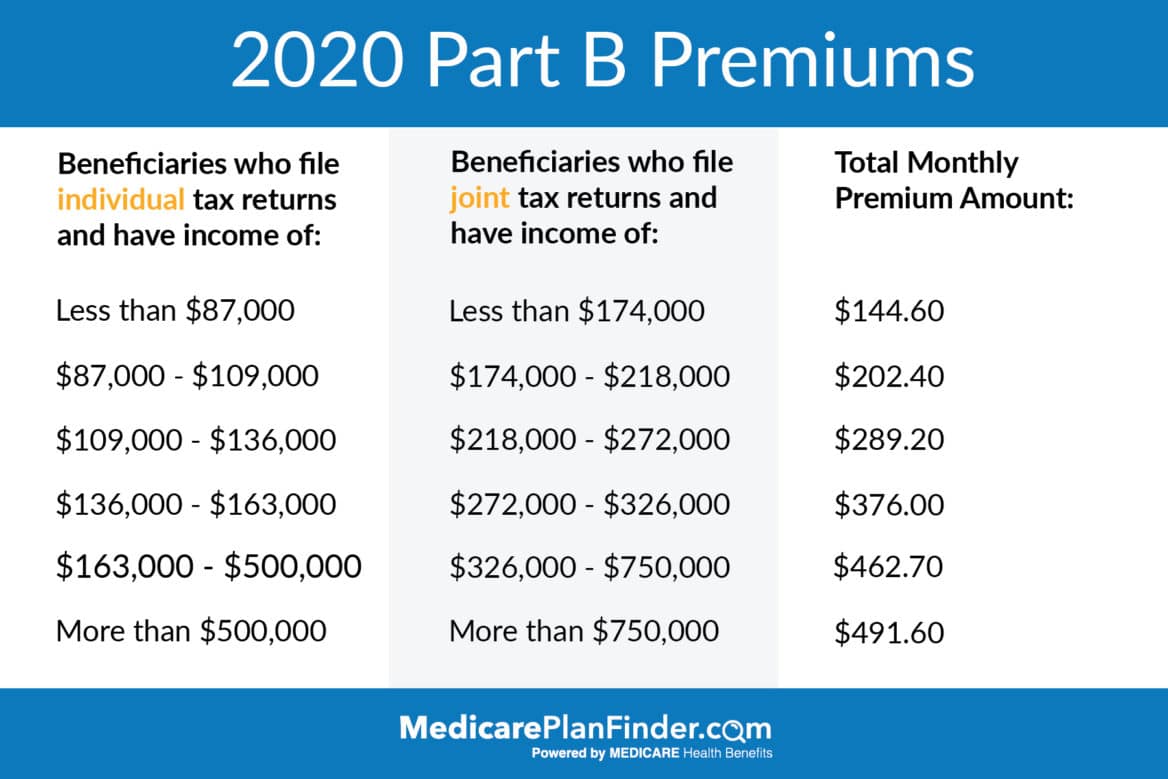

- Potential Increase: Based on current projections, the 2025 Medicare Part B premium is likely to increase compared to previous years.

- Factors Contributing to the Increase: The projected increase is attributed to factors such as rising healthcare costs, expected growth in Medicare enrollment, and potential adjustments to the program’s structure.

- Impact on Beneficiaries: The premium increase could have a significant impact on beneficiaries, particularly those on fixed incomes, who may need to adjust their budgets accordingly.

Importance of Monitoring the Premium Estimate

Staying informed about the evolving 2025 Medicare Part B premium estimate is crucial for several reasons:

- Financial Planning: The premium estimate helps beneficiaries plan their finances, ensuring they have adequate resources to cover their healthcare costs.

- Healthcare Decision-Making: Understanding the potential premium increase allows beneficiaries to make informed decisions about their healthcare choices, such as considering alternative treatment options or utilizing preventative services.

- Advocacy and Policy Awareness: Monitoring the premium estimate highlights the importance of advocating for policies that ensure affordable and accessible healthcare for all.

FAQs Regarding the 2025 Medicare Part B Premium Estimate

Q: When will the exact 2025 Medicare Part B premium be announced?

A: The official premium amount is typically announced by the CMS in the fall of the year preceding the new benefit period, which begins on January 1st.

Q: How can I stay informed about the latest premium estimates?

A: Reliable sources for information include the official CMS website, the Medicare Rights Center, and reputable financial publications.

Q: What can I do to prepare for potential premium increases?

A:

- Review your budget: Analyze your current spending and identify potential areas for savings.

- Explore alternative healthcare options: Consider options like Medicare Advantage plans, which may offer lower premiums and additional benefits.

- Engage in preventative care: Maintaining good health through preventative screenings and healthy lifestyle choices can help reduce future healthcare costs.

Tips for Managing Medicare Part B Premiums

- Consider a Medicare Advantage Plan: These plans often offer lower premiums and additional benefits compared to traditional Medicare.

- Enroll in the Medicare Savings Program (MSP): The MSP helps eligible individuals pay for their Medicare premiums, deductibles, and coinsurance.

- Explore Low-Income Subsidies: Individuals with limited income may qualify for subsidies that help reduce their Medicare Part B premiums.

- Negotiate with Providers: Consider negotiating with healthcare providers to reduce out-of-pocket costs.

Conclusion

The 2025 Medicare Part B premium estimate serves as a vital tool for beneficiaries to plan their healthcare finances and make informed decisions about their healthcare options. Staying informed about the evolving projections and exploring strategies for managing premiums can help ensure access to quality healthcare while navigating the complexities of the Medicare system. As the healthcare landscape continues to evolve, understanding the implications of premium estimates becomes increasingly important for beneficiaries seeking to maintain their health and financial well-being.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future of Medicare Part B: Understanding the 2025 Premium Estimate. We thank you for taking the time to read this article. See you in our next article!