Navigating the Future: Understanding Projected Medicare Part B Premiums for 2025

Navigating the Future: Understanding Projected Medicare Part B Premiums for 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future: Understanding Projected Medicare Part B Premiums for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Understanding Projected Medicare Part B Premiums for 2025

As individuals approach retirement and Medicare eligibility, understanding the financial landscape becomes paramount. Among the various aspects of Medicare, Part B, which covers physician services, outpatient care, and preventive services, plays a crucial role in managing healthcare costs. Projecting future Part B premiums provides valuable insight into potential financial obligations, enabling individuals to plan accordingly.

Factors Influencing Projected Premiums

The projected Part B premium for 2025 is subject to several dynamic factors, including:

- Inflation: The rate of inflation directly impacts healthcare costs, which in turn influences the premium. Rising inflation necessitates higher premiums to maintain the program’s financial stability.

- Utilization of Services: Increased utilization of healthcare services, driven by factors such as an aging population and advancements in medical technology, can lead to higher premiums.

- Government Spending: The federal government’s budgetary decisions and allocation of resources for Medicare significantly impact premium projections.

- Negotiation Power with Drug Companies: The government’s ability to negotiate lower drug prices can potentially reduce premiums.

- Economic Conditions: Fluctuations in the overall economy, including unemployment rates and economic growth, can influence premium projections.

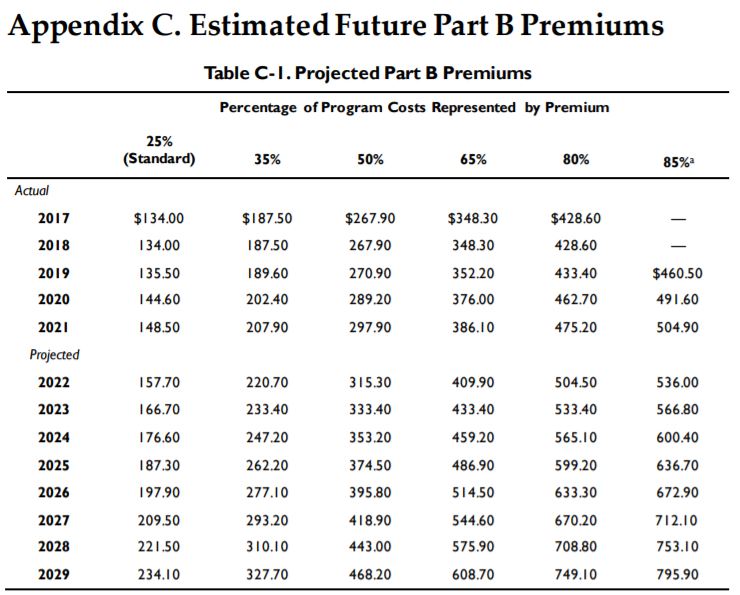

Projected Premiums for 2025: A Glimpse into the Future

While precise figures for 2025 premiums are not yet available, analysts and experts provide projections based on current trends and historical data. It is crucial to understand that these projections are subject to change based on unforeseen events and policy decisions.

Current projections suggest a potential increase in Part B premiums for 2025. However, the exact amount of the increase remains uncertain. Factors such as the rate of inflation, utilization of services, and government spending will play a significant role in determining the final premium.

Importance of Understanding Projected Premiums

Comprehending projected Part B premiums for 2025 offers several benefits:

- Financial Planning: Individuals can factor potential premium increases into their retirement planning, ensuring adequate financial resources to cover healthcare expenses.

- Budgeting: By anticipating future premium costs, individuals can adjust their budgets accordingly, minimizing financial stress and ensuring sufficient funds for other essential needs.

- Making Informed Decisions: Understanding projected premiums allows individuals to make informed decisions regarding healthcare choices, such as considering alternative healthcare options or adjusting their utilization of services.

FAQs: Addressing Common Concerns

Q: How are Part B premiums calculated?

A: Part B premiums are calculated based on a complex formula that considers factors such as the program’s projected costs, beneficiary income, and government spending.

Q: Can I avoid paying Part B premiums?

A: Individuals with high enough incomes may be subject to an income-related monthly adjustment amount (IRMAA), which increases their Part B premiums. However, it is not possible to completely avoid paying Part B premiums unless you are exempt from enrolling in Part B due to specific circumstances.

Q: Will Part B premiums continue to increase in the future?

A: While it is difficult to predict with certainty, current trends suggest that Part B premiums are likely to continue increasing in the future due to factors such as rising healthcare costs and an aging population.

Tips for Managing Medicare Part B Costs

- Enroll Promptly: Enroll in Part B as soon as you are eligible to avoid potential late enrollment penalties.

- Consider a Medicare Advantage Plan: These plans often offer lower premiums and additional benefits, but may have limitations on coverage.

- Utilize Preventive Services: Taking advantage of preventive services covered by Part B can help prevent costly health issues in the future.

- Shop for Prescription Drugs: Compare prices and consider alternative medications to minimize drug costs.

- Stay Informed: Keep abreast of changes in Medicare policy and premiums to make informed decisions about your healthcare coverage.

Conclusion: Preparing for the Future

Understanding projected Medicare Part B premiums for 2025 is essential for individuals approaching retirement and navigating the complexities of healthcare financing. By staying informed, planning accordingly, and taking advantage of available resources, individuals can proactively manage their healthcare costs and ensure a secure financial future. While projected premiums provide valuable insight, it is crucial to remember that these figures are subject to change based on unforeseen circumstances and policy decisions. Continuously monitoring and adapting to evolving healthcare trends is essential for maintaining financial stability in retirement.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Understanding Projected Medicare Part B Premiums for 2025. We thank you for taking the time to read this article. See you in our next article!