Navigating the Medicare Part B Premium Landscape for 2025

Navigating the Medicare Part B Premium Landscape for 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Medicare Part B Premium Landscape for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Medicare Part B Premium Landscape for 2025

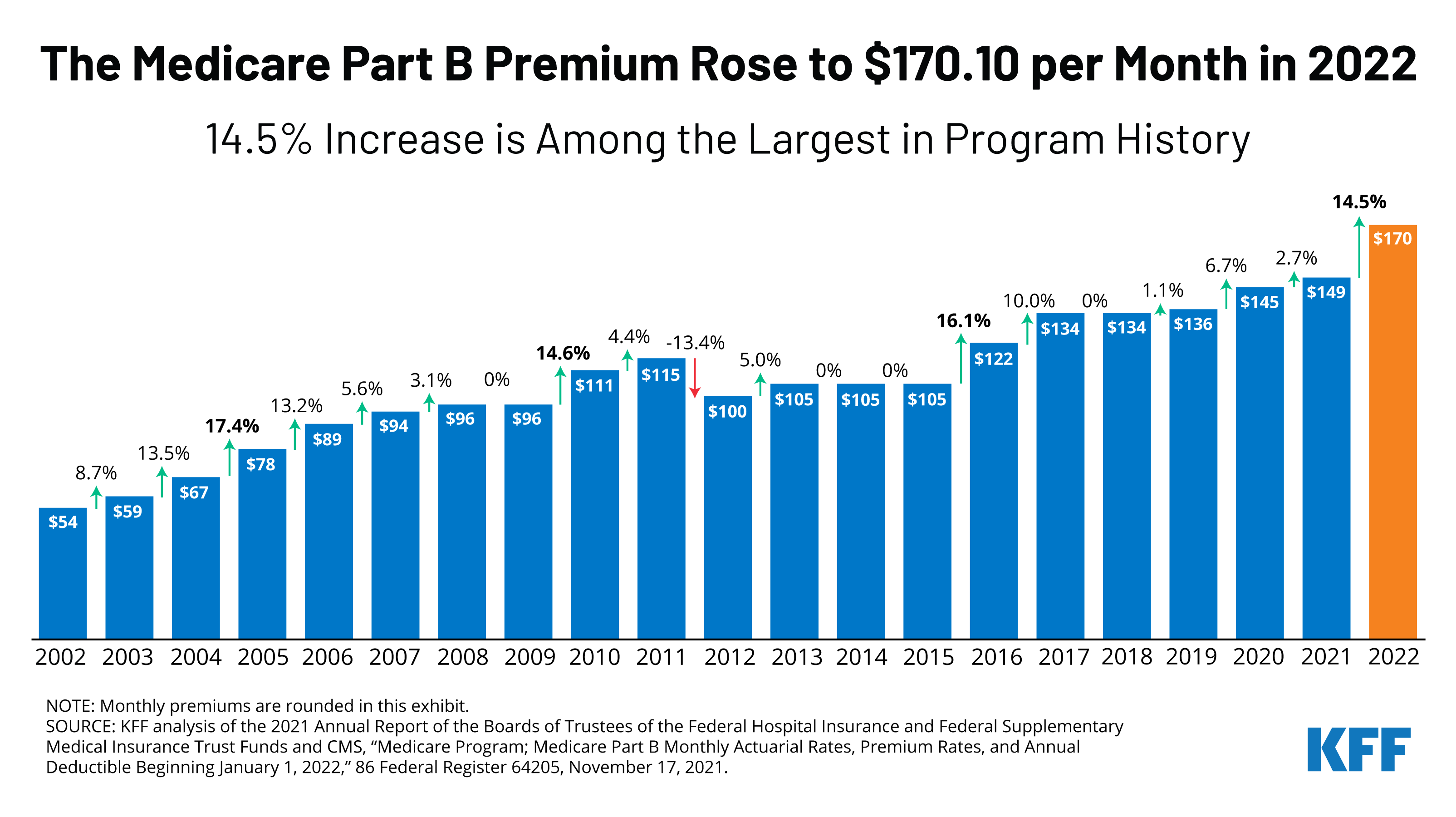

The Medicare program, a cornerstone of healthcare for millions of Americans, is constantly evolving. One aspect of this evolution that frequently draws attention is the annual adjustment of Medicare Part B premiums, which cover outpatient medical services, such as doctor visits, outpatient surgery, and preventive services.

While the specific amount of the premium increase for 2025 is yet to be announced, understanding the factors that influence this adjustment and its potential implications is crucial for beneficiaries.

Factors Driving Premium Adjustments

The Medicare Part B premium is determined annually through a complex process that considers several key factors:

- Projected Costs of Medicare-Covered Services: The most significant factor driving premium adjustments is the anticipated cost of providing healthcare services to Medicare beneficiaries. Rising healthcare costs, including inflation, technological advancements, and the development of new treatments, directly impact the premium.

- Enrollment Trends: The number of individuals enrolled in Medicare Part B plays a role in premium calculations. As the population ages and more people become eligible for Medicare, the cost of providing services to a larger beneficiary pool is factored into the premium.

- Government Spending: The federal government’s spending on Medicare is also considered. Budgetary constraints and policy decisions can influence the level of funding available for the program, potentially affecting the premium.

- Actuarial Estimates: The Centers for Medicare & Medicaid Services (CMS) uses actuarial projections to estimate future healthcare costs and enrollment trends. These projections are crucial for determining the appropriate premium level.

Potential Implications of Premium Increases

While premium increases are a necessary part of maintaining the sustainability of the Medicare program, they can have a significant impact on beneficiaries, particularly those on fixed incomes.

- Budgetary Strain: Higher premiums can strain the budgets of individuals relying on Medicare for healthcare coverage, especially those living on limited resources.

- Access to Care: For some beneficiaries, the increase in premiums might lead to difficulties affording necessary medical care, potentially impacting their health outcomes.

- Decision-Making: The premium adjustment may prompt beneficiaries to reconsider their healthcare choices, such as delaying or forgoing certain treatments or services due to cost concerns.

Understanding the Announcement Process

The annual announcement of Medicare Part B premium adjustments typically occurs in the fall, a few months before the new year. CMS releases a detailed report outlining the factors that contributed to the change, the projected premium amount, and other relevant information.

Navigating the Information Landscape

Staying informed about premium adjustments is crucial for beneficiaries. Here are some resources to access reliable information:

- Medicare.gov: The official website of Medicare offers comprehensive information on the program, including details about Part B premiums, benefits, and enrollment.

- Social Security Administration: The Social Security Administration website provides information on Medicare premiums and other benefits, including potential deductions and subsidies.

- Local Senior Centers and Organizations: Many local senior centers and organizations offer educational programs and resources about Medicare, including updates on premium adjustments.

Frequently Asked Questions (FAQs)

Q: How are Medicare Part B premiums determined?

A: Medicare Part B premiums are determined annually by CMS based on projected costs of providing healthcare services, enrollment trends, government spending, and actuarial estimates.

Q: When are Medicare Part B premium adjustments announced?

A: The annual announcement of Medicare Part B premium adjustments typically occurs in the fall, a few months before the new year.

Q: How can I stay informed about Medicare Part B premium adjustments?

A: You can stay informed by visiting Medicare.gov, the Social Security Administration website, or contacting your local senior center or organization.

Q: What can I do if I’m concerned about the affordability of Medicare Part B premiums?

A: If you’re concerned about the affordability of Medicare Part B premiums, you can explore options such as:

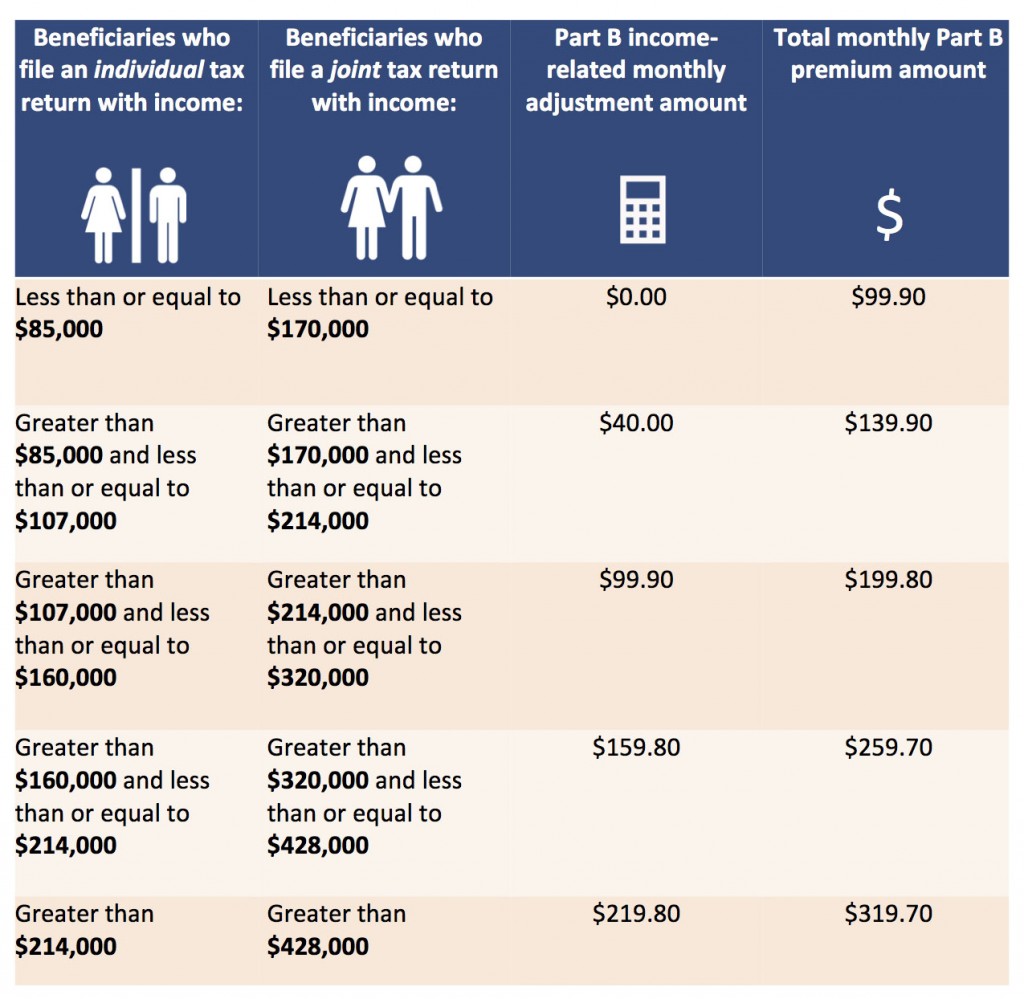

- Income-Related Monthly Adjustment Amount (IRMAA): This program adjusts premiums based on income for higher-income beneficiaries.

- Medicare Savings Programs: These programs offer financial assistance to low-income individuals to help cover Medicare costs.

- Medicare Advantage Plans: These private health insurance plans offer alternative coverage options with varying premium structures.

Tips for Managing Medicare Part B Premiums

- Review Your Medicare Coverage: Regularly review your Medicare coverage to ensure it meets your current needs and budget.

- Explore Cost-Saving Options: Consider options like preventive care and generic medications to potentially reduce healthcare expenses.

- Consider Medicare Advantage Plans: Explore the possibility of switching to a Medicare Advantage plan that might offer lower premiums or additional benefits.

- Contact Medicare or a Benefits Counselor: Seek guidance from Medicare or a benefits counselor for personalized advice on managing your premiums.

Conclusion

The annual adjustment of Medicare Part B premiums is a complex process influenced by various factors. While premium increases are a necessary part of maintaining the sustainability of the Medicare program, they can impact beneficiaries’ budgets and healthcare access. By understanding the factors that drive premium adjustments, staying informed about announcements, and exploring available resources and options, beneficiaries can navigate this evolving landscape and ensure access to the healthcare they need.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Medicare Part B Premium Landscape for 2025. We hope you find this article informative and beneficial. See you in our next article!