Navigating the Projected Medicare Part B Premium Increase for 2025

Navigating the Projected Medicare Part B Premium Increase for 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Projected Medicare Part B Premium Increase for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Projected Medicare Part B Premium Increase for 2025

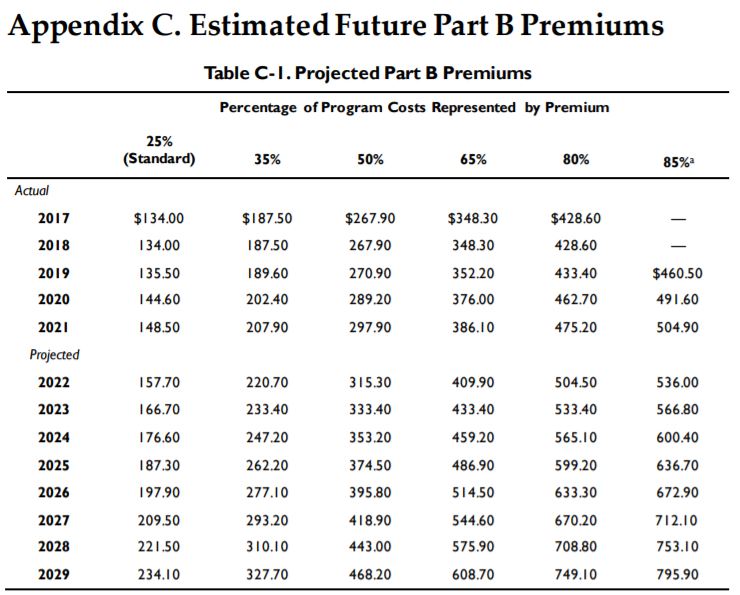

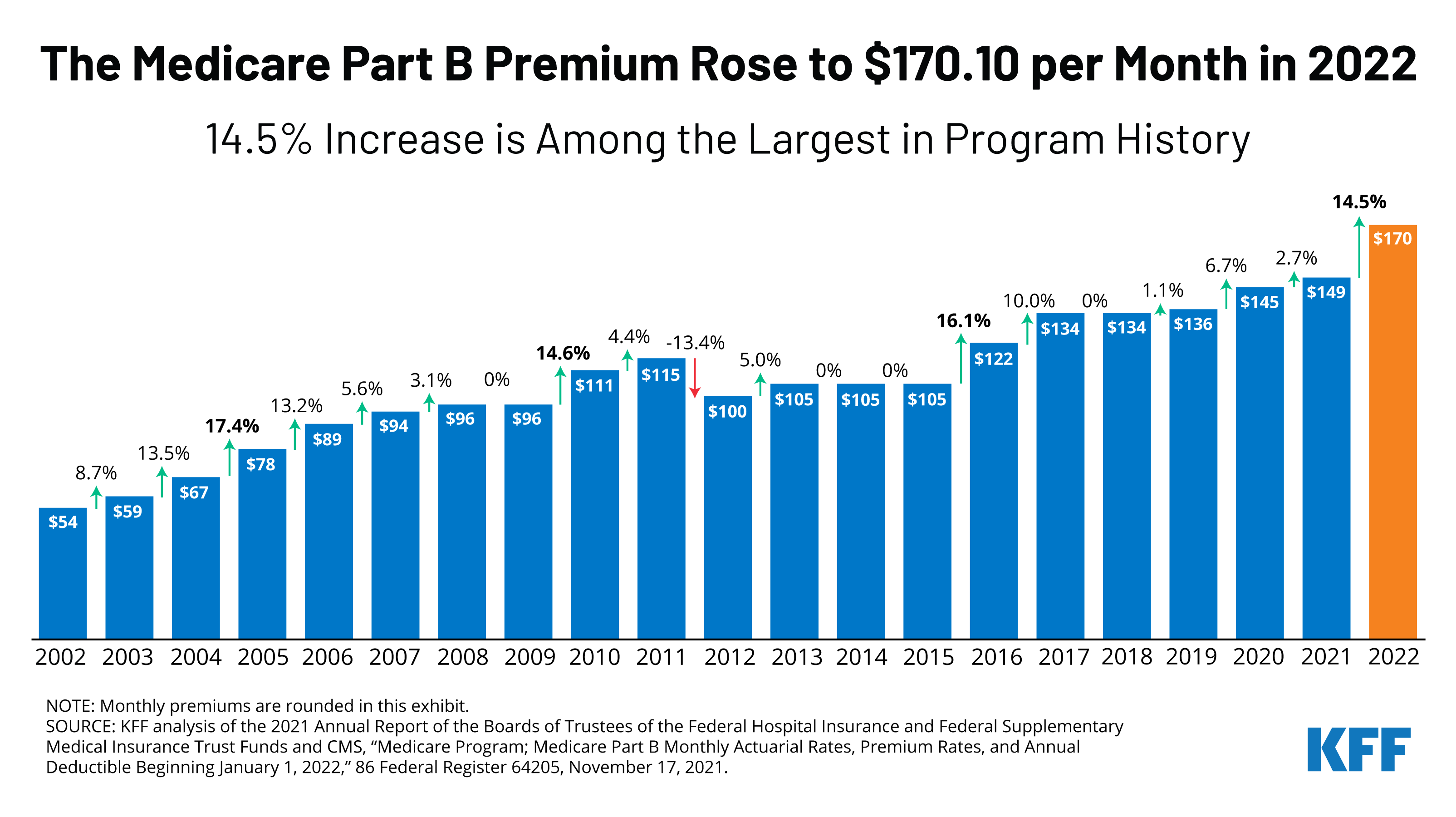

The Medicare Part B premium, which covers doctor visits, outpatient care, and other medical services, is subject to annual adjustments. Projections for the 2025 premium indicate a potential increase, raising concerns for beneficiaries and prompting questions about its impact on healthcare affordability. This article delves into the factors driving these projections, the potential implications for beneficiaries, and strategies for managing the financial burden.

Understanding the Drivers of Projected Premium Increases

Several factors contribute to the anticipated increase in Medicare Part B premiums for 2025.

- Rising Healthcare Costs: The escalating costs of medical services, pharmaceuticals, and administrative expenses are primary drivers of premium adjustments. As healthcare inflation outpaces general inflation, the program faces increasing pressure to cover its obligations.

- Medicare’s Trust Fund: The Medicare Trust Fund, which finances Part A (hospital insurance), is projected to become insolvent in the coming years. To mitigate this, the program may need to draw upon Part B premiums to cover its expenses, potentially leading to higher premiums for beneficiaries.

- Enrollment Trends: The aging population and increasing healthcare utilization among beneficiaries contribute to rising costs and necessitate higher premiums to maintain program sustainability.

- Political Considerations: Government policies and budget decisions, such as changes in reimbursement rates for healthcare providers, can influence the trajectory of Medicare Part B premiums.

Potential Impact on Beneficiaries

The projected increase in Medicare Part B premiums could have significant implications for beneficiaries, particularly those with fixed incomes or limited financial resources. Higher premiums can:

- Reduce Disposable Income: Increased premiums can strain household budgets, leaving less money for other essential expenses, such as food, housing, and transportation.

- Impact Healthcare Access: Some beneficiaries may struggle to afford necessary medical services due to higher premiums, potentially leading to delayed care or forgoing treatment altogether.

- Amplify Healthcare Disparities: The financial burden of higher premiums could disproportionately affect vulnerable populations, such as low-income individuals, minorities, and those with chronic health conditions.

Strategies for Managing the Financial Burden

While the projected premium increase poses challenges, beneficiaries can explore strategies to mitigate its impact:

- Enroll in a Medicare Savings Program: State-administered programs, such as the Qualified Medicare Beneficiary (QMB) and the Specified Low-Income Medicare Beneficiary (SLMB), can help eligible individuals pay for Medicare premiums, deductibles, and coinsurance.

- Consider a Medicare Advantage Plan: These plans, offered by private insurance companies, may have lower premiums than traditional Medicare, though they often have limitations on coverage and provider networks.

- Explore Cost-Sharing Options: Programs like the Extra Help program can assist with prescription drug costs, while the Medicare Part B Low-Income Subsidy can help with premium payments.

- Seek Financial Counseling: Organizations like the National Council on Aging and the Medicare Rights Center offer free counseling services to help beneficiaries navigate Medicare and understand their financial options.

FAQs about Projected 2025 Medicare Part B Premium Increase

1. When will the 2025 Medicare Part B premium be finalized?

The Centers for Medicare & Medicaid Services (CMS) typically announces the annual premium adjustments in the fall of the preceding year. Therefore, the final 2025 premium is expected to be announced in late 2024.

2. How can I get more information about the 2025 premium increase?

You can find updates and resources on the CMS website, as well as from advocacy groups like the Medicare Rights Center and the National Council on Aging.

3. What if I can’t afford the higher premiums?

If you are struggling to afford the premiums, you can explore the options mentioned earlier, such as Medicare Savings Programs, Medicare Advantage plans, and financial counseling services.

Tips for Beneficiaries

- Stay Informed: Monitor official announcements from CMS and advocacy organizations to stay updated on premium adjustments and related policies.

- Review Your Coverage: Assess your current Medicare coverage to ensure it meets your needs and explore alternative options if necessary.

- Budget Wisely: Plan your budget to account for potential premium increases and other healthcare expenses.

- Seek Professional Help: If you are facing financial challenges related to Medicare premiums, contact a financial counselor or advocate for guidance.

Conclusion

The projected increase in Medicare Part B premiums for 2025 highlights the ongoing challenges of ensuring healthcare affordability for a growing aging population. While the financial burden of higher premiums can be significant, beneficiaries can navigate these challenges by staying informed, exploring available resources, and seeking professional guidance. By understanding the factors driving premium increases and utilizing available strategies, individuals can strive to maintain access to quality healthcare while managing their financial well-being.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Projected Medicare Part B Premium Increase for 2025. We appreciate your attention to our article. See you in our next article!