Understanding Medicare Part B IRMAA Premiums in 2025: A Comprehensive Guide

Understanding Medicare Part B IRMAA Premiums in 2025: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding Medicare Part B IRMAA Premiums in 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding Medicare Part B IRMAA Premiums in 2025: A Comprehensive Guide

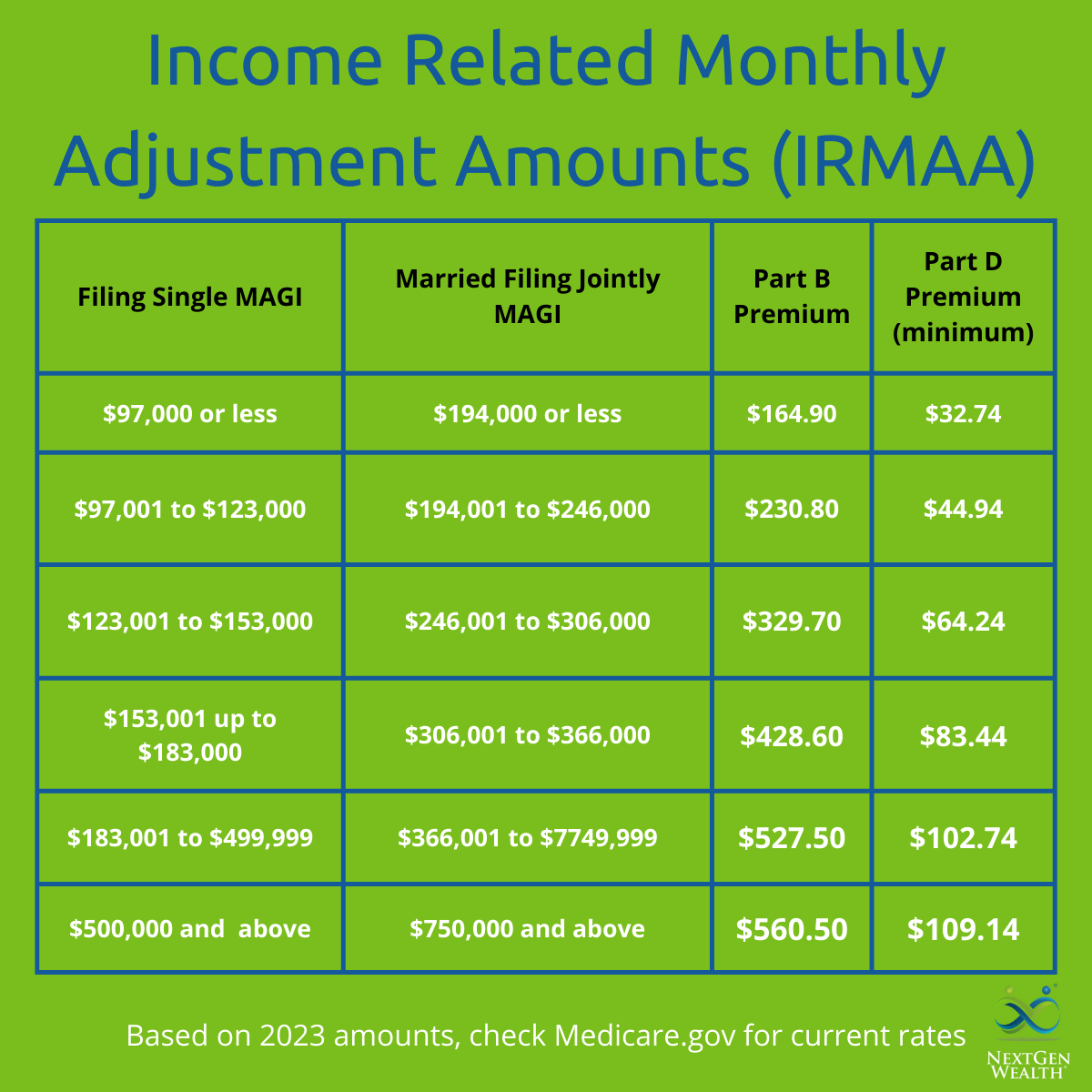

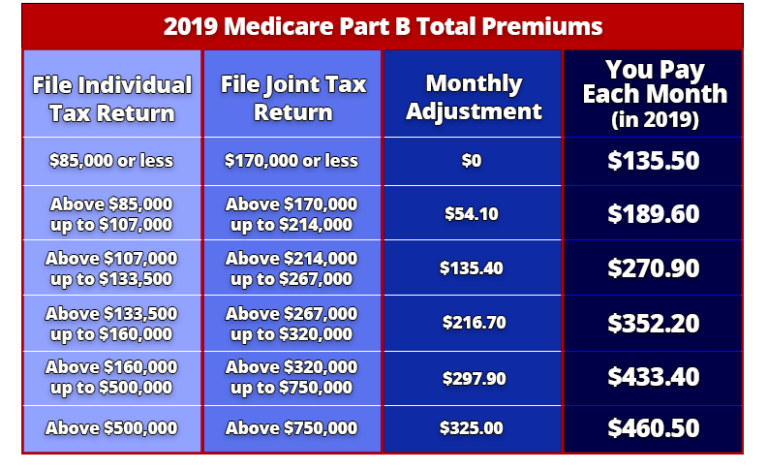

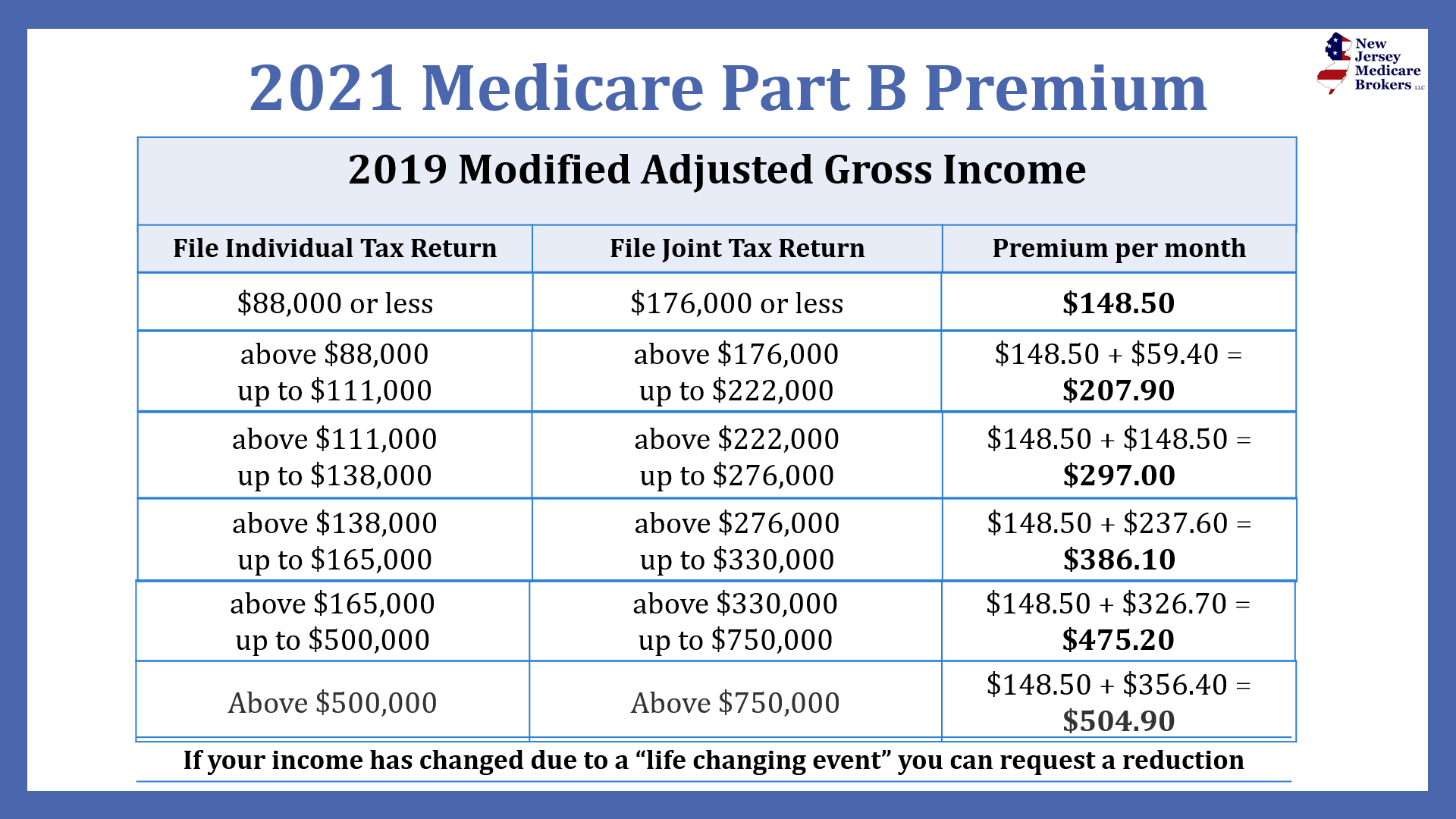

Medicare Part B, which covers physician services, outpatient care, and other medical services, is an essential component of healthcare for many Americans. However, for individuals with higher incomes, the cost of Part B can be significantly increased through the Income-Related Monthly Adjustment Amount (IRMAA). This article aims to provide a detailed explanation of the IRMAA brackets for 2025, highlighting the factors that determine premium adjustments and the strategies individuals can utilize to potentially mitigate these costs.

What is IRMAA and Why Does it Exist?

IRMAA is a mechanism designed to ensure that individuals with higher incomes contribute a proportionally greater share towards the cost of Medicare. It operates on a tiered system, with higher income levels corresponding to progressively higher Part B premiums. The purpose of IRMAA is to distribute the cost of Medicare more equitably, ensuring that the program remains sustainable for all beneficiaries.

Determining Your IRMAA Bracket for 2025

The IRMAA brackets for 2025 are based on the Modified Adjusted Gross Income (MAGI), which is a modified version of your adjusted gross income (AGI) as reported on your federal tax return. The MAGI calculation includes adjustments for certain income sources, such as tax-exempt interest income and certain pension income.

2025 IRMAA Brackets and Corresponding Part B Premiums:

| MAGI Range (Single Filers) | MAGI Range (Joint Filers) | Part B Premium |

|---|---|---|

| $0 – $91,000 | $0 – $182,000 | Standard Premium |

| $91,001 – $114,000 | $182,001 – $228,000 | $244 per month |

| $114,001 – $138,000 | $228,001 – $276,000 | $359 per month |

| $138,001 – $162,000 | $276,001 – $324,000 | $521 per month |

| $162,001 – $186,000 | $324,001 – $372,000 | $661 per month |

| $186,001+ | $372,001+ | $789 per month |

Important Considerations:

- Filing Status: The MAGI thresholds vary based on your filing status (single, married filing jointly, etc.).

- Changes in Income: If your income changes significantly during the year, it is essential to update your IRMAA status with Medicare. This may result in adjustments to your Part B premiums.

- Medicare Advantage Plans: While IRMAA applies to traditional Medicare Part B, it may not apply to Medicare Advantage plans. Check with your plan provider for specific details.

Strategies for Managing IRMAA Costs

While IRMAA is a mandatory component of Medicare, there are strategies individuals can consider to potentially mitigate its impact:

- Tax Planning: Carefully review your tax deductions and credits to minimize your AGI and potentially reduce your MAGI.

- Retirement Planning: Consider withdrawing less from retirement accounts, as this can impact your MAGI.

- Income-Generating Strategies: Explore alternative income sources that may not be subject to MAGI adjustments, such as rental income or dividends.

- Medicare Advantage Plans: Evaluate whether a Medicare Advantage plan offers lower premiums or other benefits compared to traditional Medicare Part B.

Frequently Asked Questions (FAQs) about IRMAA:

Q: How is my MAGI calculated?

A: Your MAGI is calculated based on your AGI, with adjustments for certain income sources, such as tax-exempt interest income and pension income. Consult IRS Publication 929 for detailed information.

Q: When does IRMAA take effect?

A: IRMAA is typically applied to your Medicare Part B premiums starting in January of the year following the year your income was reported on your federal tax return.

Q: Can I appeal an IRMAA determination?

A: Yes, you can appeal an IRMAA determination if you believe it is incorrect. The appeal process involves providing documentation to support your claim.

Q: What if my income decreases significantly after I’ve been assessed IRMAA?

A: If your income decreases significantly, you can contact Medicare to update your IRMAA status and potentially receive a lower premium.

Tips for Understanding and Managing IRMAA:

- Review your tax returns: Carefully examine your tax returns to understand your AGI and how it is calculated.

- Consult with a tax professional: Seek advice from a qualified tax professional to explore strategies for minimizing your MAGI.

- Stay informed about Medicare changes: Regularly review information from Medicare.gov to stay informed about changes to IRMAA and other Medicare programs.

- Contact Medicare directly: If you have any questions or concerns about IRMAA, contact Medicare directly for assistance.

Conclusion

IRMAA is an important aspect of Medicare that impacts individuals with higher incomes. Understanding the factors that influence your IRMAA bracket, exploring strategies to potentially mitigate its impact, and staying informed about changes to the program are crucial steps in managing your Medicare costs effectively. By taking proactive steps to manage your income and tax planning, you can ensure that you are paying the appropriate premium for Medicare Part B and maximizing your benefits.

Closure

Thus, we hope this article has provided valuable insights into Understanding Medicare Part B IRMAA Premiums in 2025: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!