Understanding Medicare Part B Premium Increases: A Guide for 2025

Understanding Medicare Part B Premium Increases: A Guide for 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Understanding Medicare Part B Premium Increases: A Guide for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding Medicare Part B Premium Increases: A Guide for 2025

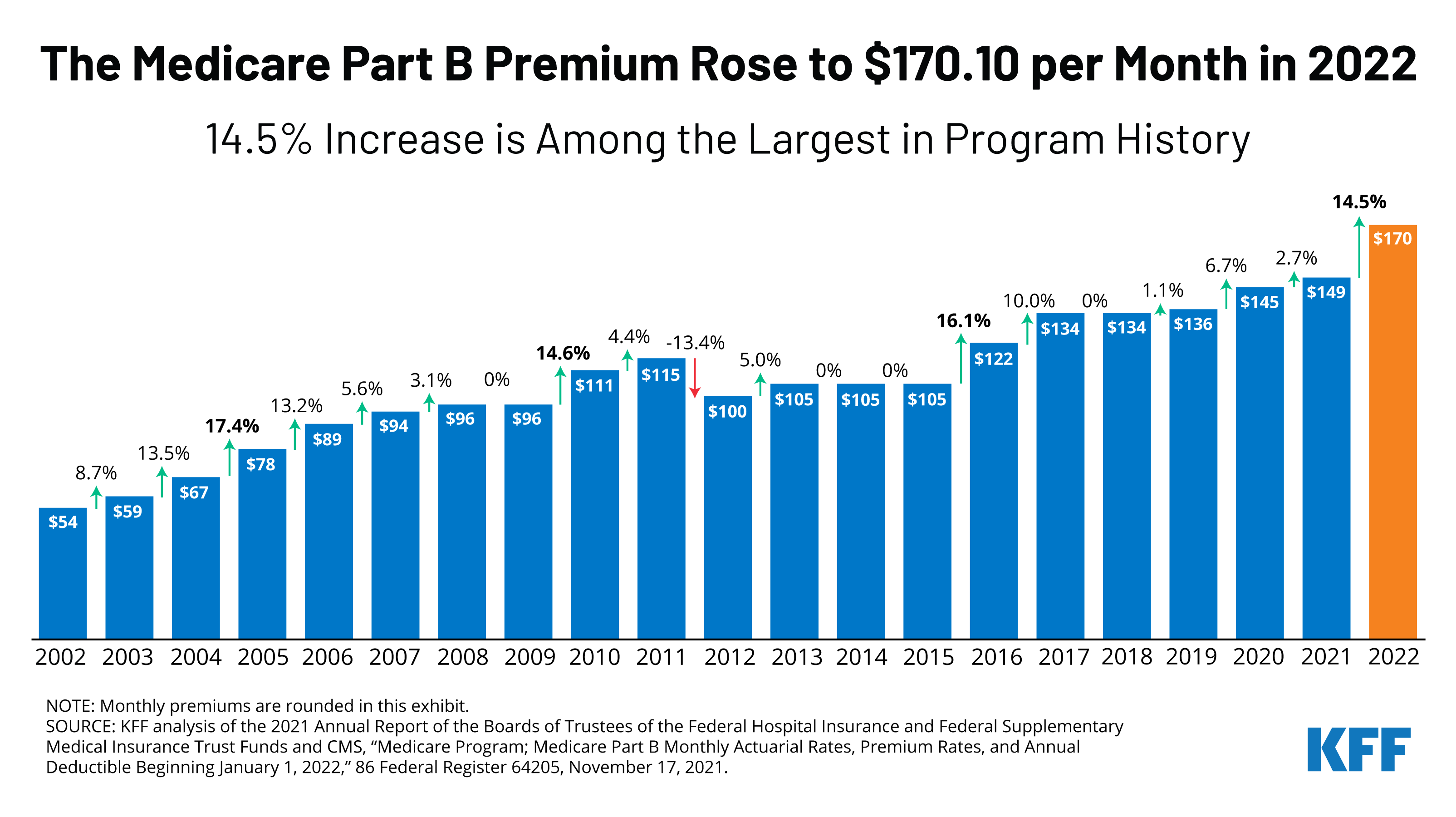

Medicare Part B, which covers doctor visits, outpatient care, and other medical services, is a crucial component of the healthcare system for millions of Americans. However, like many aspects of healthcare, Part B premiums are subject to annual adjustments. These adjustments, often reflected in a chart format, are crucial for beneficiaries to understand as they directly impact their out-of-pocket costs.

2025 Medicare Part B Premium Projections: A Look Ahead

While the exact figures for 2025 are not yet finalized, it is essential to understand the factors that influence these adjustments and how they affect beneficiaries.

- The Social Security Trustees Report: This report, released annually, provides a detailed analysis of the financial health of the Social Security and Medicare programs. It offers insights into projected costs and potential changes to benefits, including Medicare Part B premiums.

- The Medicare Trustees Report: This report focuses specifically on Medicare, providing projections for future costs and potential changes to program benefits, including Part B premiums.

- Inflation and Healthcare Costs: Rising healthcare costs, including the cost of prescription drugs and medical services, significantly impact Medicare Part B premiums.

- The Federal Budget: Government spending priorities, including Medicare funding, can influence premium adjustments.

The Importance of Understanding Medicare Part B Premium Changes

The annual adjustments to Medicare Part B premiums have a direct impact on beneficiaries’ out-of-pocket healthcare costs. Understanding these changes allows individuals to:

- Plan for Future Healthcare Expenses: Knowing potential premium increases enables beneficiaries to budget accordingly and prepare for potential changes in their out-of-pocket costs.

- Make Informed Decisions: Understanding the factors driving premium adjustments can help beneficiaries advocate for policies that support affordable healthcare.

- Explore Potential Cost-Saving Strategies: Awareness of premium changes can prompt beneficiaries to explore alternative healthcare options or seek ways to reduce their overall healthcare expenses.

Navigating the 2025 Medicare Part B Premium Chart

The 2025 Medicare Part B premium chart, once released, will likely be a downloadable PDF document. This chart will typically include:

- Monthly Premium Amount: The chart will display the monthly premium amount for each income bracket, reflecting the income-related monthly adjustment amount (IRMAA).

- Income Brackets: The chart will outline various income brackets, each associated with a specific premium amount.

- IRMAA: The chart will likely include a separate section detailing the IRMAA, which applies to individuals with higher incomes.

Frequently Asked Questions (FAQs)

Q: When will the 2025 Medicare Part B premium chart be released?

A: The official premium chart for 2025 is typically released in the fall of the preceding year.

Q: How are Medicare Part B premiums calculated?

A: Medicare Part B premiums are calculated based on a complex formula that considers factors like healthcare costs, the cost of administering the program, and the financial health of the Medicare trust fund.

Q: What is the IRMAA, and how does it affect my premiums?

A: The Income-Related Monthly Adjustment Amount (IRMAA) is an additional premium that applies to individuals with higher incomes. The IRMAA amount is based on your adjusted gross income (AGI) reported on your federal income tax return.

Q: Can I do anything to lower my Medicare Part B premiums?

A: While you cannot directly control the premium amount, you can explore options like:

- Enroll in a Medicare Advantage plan: These plans often offer lower premiums than traditional Medicare, but they may have limitations on coverage.

- Consider a Medicare Supplement plan: These plans can help cover some of your out-of-pocket costs, including Medicare Part B premiums.

- Review your income: If your income is significantly lower than in previous years, you may be eligible for a lower premium.

Tips for Staying Informed about 2025 Medicare Part B Premium Changes

- Sign up for email alerts: The Centers for Medicare & Medicaid Services (CMS) and other reliable sources offer email alerts to notify you about premium changes.

- Visit the official CMS website: The CMS website is a valuable resource for the latest information on Medicare Part B premiums.

- Contact your local Social Security office: Social Security representatives can provide personalized guidance on Medicare Part B premiums.

Conclusion

Understanding the factors that influence Medicare Part B premium increases is crucial for beneficiaries to plan for their healthcare expenses and advocate for policies that support affordable healthcare. By staying informed about potential changes and exploring cost-saving options, individuals can navigate the complexities of Medicare and ensure they receive the care they need while managing their out-of-pocket costs.

Closure

Thus, we hope this article has provided valuable insights into Understanding Medicare Part B Premium Increases: A Guide for 2025. We appreciate your attention to our article. See you in our next article!