Understanding Medicare Part B Premiums in 2025: A Guide for Beneficiaries

Understanding Medicare Part B Premiums in 2025: A Guide for Beneficiaries

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding Medicare Part B Premiums in 2025: A Guide for Beneficiaries. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding Medicare Part B Premiums in 2025: A Guide for Beneficiaries

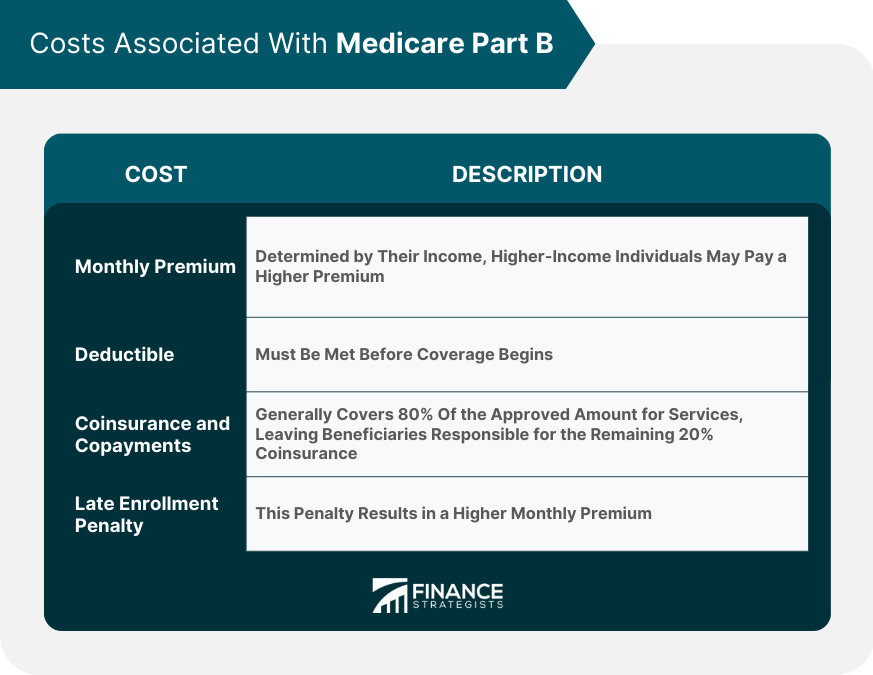

Medicare Part B is a crucial component of the federal health insurance program, covering physician services, outpatient care, and other medical necessities. The cost of this coverage is determined by a monthly premium, subject to annual adjustments based on various factors. This article provides a comprehensive overview of the 2025 standard Medicare Part B premium, exploring its key aspects and implications for beneficiaries.

Factors Influencing the 2025 Standard Medicare Part B Premium:

The annual determination of the standard Medicare Part B premium involves a complex interplay of factors, including:

- Projected Healthcare Costs: The rising costs of medical services and treatments directly impact the premium amount. As healthcare expenses increase, the premium adjusts to reflect these changes.

- Government Spending: The federal government’s budget allocation towards Medicare plays a significant role in determining the premium. Changes in government spending on healthcare can lead to adjustments in the premium.

- Enrollment Numbers: The number of individuals enrolled in Medicare Part B influences the premium. A larger enrollment base spreads the cost over a wider pool, potentially leading to a lower premium.

- Economic Conditions: Broad economic factors, such as inflation and interest rates, can influence the premium. These factors affect the overall cost of providing healthcare services, which in turn impacts the premium amount.

The Importance of Understanding the 2025 Standard Medicare Part B Premium:

Understanding the standard Medicare Part B premium for 2025 is crucial for beneficiaries as it directly impacts their healthcare budget. The premium represents a significant financial commitment, and beneficiaries need to factor it into their overall financial planning.

Estimating the 2025 Standard Medicare Part B Premium:

While the exact premium amount for 2025 is not yet available, it is possible to estimate it based on historical trends and projected changes in healthcare costs.

- Historical Trends: Examining the premium adjustments in recent years can provide insights into potential future changes.

- Projected Healthcare Cost Increases: Healthcare cost projections can be used to estimate the potential impact on the premium.

- Government Budget Updates: Announcements regarding Medicare funding and budgetary allocations can provide clues about potential premium adjustments.

Potential Impacts of the 2025 Standard Medicare Part B Premium:

The 2025 standard Medicare Part B premium could have several implications for beneficiaries, including:

- Budgetary Constraints: An increase in the premium could place a strain on beneficiaries’ budgets, especially those on fixed incomes.

- Healthcare Access: Higher premiums could lead some beneficiaries to delay or forgo necessary medical care due to financial concerns.

- Medicare Enrollment Decisions: The premium amount could influence individuals’ decisions regarding enrollment in Medicare Part B, particularly for those considering delaying enrollment.

FAQs Regarding the 2025 Standard Medicare Part B Premium:

Q: When will the 2025 standard Medicare Part B premium be announced?

A: The Centers for Medicare & Medicaid Services (CMS) typically announces the premium amount for the upcoming year in the fall of the preceding year.

Q: How can I find out the exact premium amount for 2025?

A: The official announcement of the 2025 standard Medicare Part B premium will be made by CMS on their website and through other communication channels.

Q: Can I pay my Medicare Part B premium in installments?

A: Yes, beneficiaries can choose to pay their Medicare Part B premium in monthly installments.

Q: What happens if I cannot afford the 2025 standard Medicare Part B premium?

A: Individuals facing financial hardship may be eligible for financial assistance programs that can help cover the premium cost. Contact CMS or your local Social Security office for more information.

Tips for Managing the 2025 Standard Medicare Part B Premium:

- Review Your Budget: Analyze your income and expenses to determine how the premium will affect your overall financial plan.

- Explore Financial Assistance Programs: Research available programs that may help offset the cost of the premium.

- Enroll in Medicare Part B Early: If you are eligible for Medicare, consider enrolling in Part B as soon as possible to avoid potential penalties.

- Stay Informed: Keep up-to-date on announcements regarding the 2025 standard Medicare Part B premium and any related changes.

Conclusion:

The 2025 standard Medicare Part B premium is a significant financial consideration for beneficiaries. Understanding the factors influencing the premium and its potential impact is crucial for effective financial planning. By staying informed and exploring available resources, beneficiaries can navigate the complexities of Medicare Part B and ensure access to essential healthcare services.

![]()

Closure

Thus, we hope this article has provided valuable insights into Understanding Medicare Part B Premiums in 2025: A Guide for Beneficiaries. We hope you find this article informative and beneficial. See you in our next article!