Understanding Medicare Part B Premiums in 2025: A Guide for Seniors

Understanding Medicare Part B Premiums in 2025: A Guide for Seniors

Introduction

With great pleasure, we will explore the intriguing topic related to Understanding Medicare Part B Premiums in 2025: A Guide for Seniors. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding Medicare Part B Premiums in 2025: A Guide for Seniors

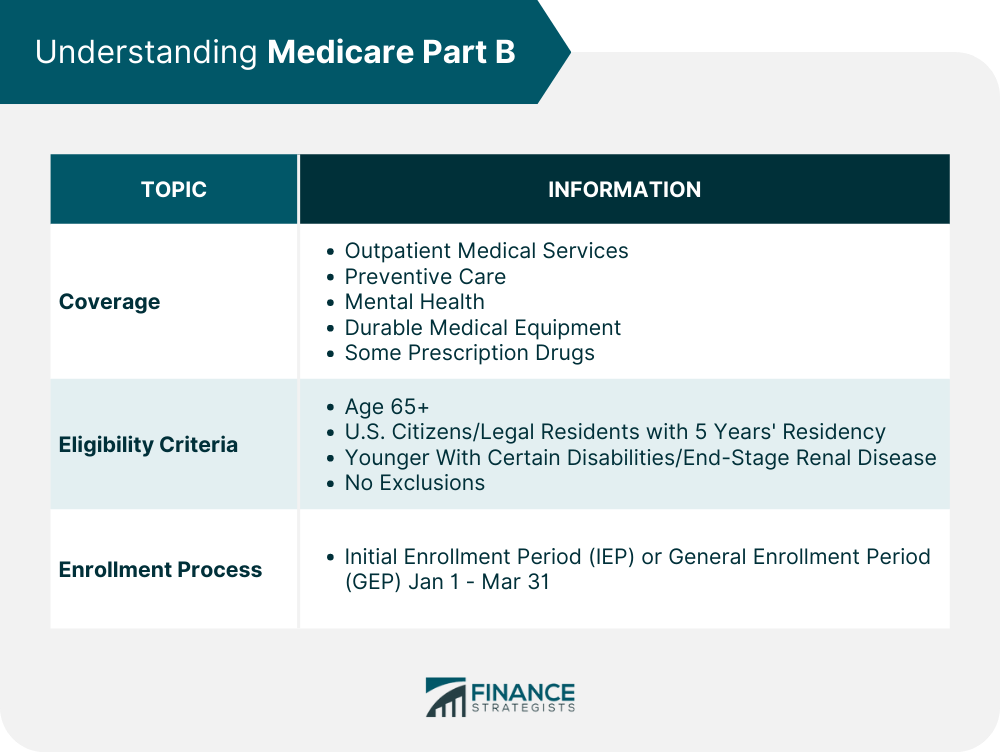

Medicare Part B, the medical insurance portion of Medicare, covers a wide range of medical services, including doctor visits, outpatient care, and preventive screenings. While Medicare is a valuable program, understanding the associated costs is crucial for beneficiaries. The annual premium for Medicare Part B is subject to change, and predicting its exact value for 2025 is currently impossible. However, analyzing historical trends and current economic factors can provide valuable insights into potential cost fluctuations.

Factors Influencing Medicare Part B Premiums:

Several factors contribute to the annual adjustment of Medicare Part B premiums. The most significant factors include:

- The cost of medical services: As healthcare costs continue to rise, the cost of providing medical services to Medicare beneficiaries also increases. This rise in costs is a primary driver for potential premium adjustments.

- Utilization of medical services: The frequency and type of medical services used by Medicare beneficiaries directly impact the overall cost of the program. Higher utilization rates can lead to increased premiums.

- The performance of the Medicare Trust Fund: The financial health of the Medicare Trust Fund, which supports the program, influences premium adjustments. A strong fund can help offset rising costs, while a declining fund may necessitate premium increases.

- Government spending and policies: Government spending priorities and policy changes can impact the funding available for Medicare, leading to potential adjustments in premiums.

Predicting the 2025 Medicare Part B Premium:

While it is impossible to predict the exact premium amount for 2025, analyzing historical trends can provide a general understanding of potential fluctuations. In recent years, Medicare Part B premiums have experienced a gradual increase, driven by factors like rising healthcare costs and increasing utilization of medical services.

Historical Trends:

- 2022: The standard monthly premium for Medicare Part B was $170.10.

- 2023: The standard monthly premium increased to $164.90.

- 2024: The standard monthly premium is $177.10.

Projected Trends:

Based on current trends, it is likely that the Medicare Part B premium will continue to increase in 2025. However, the exact amount of the increase is uncertain and will be influenced by the factors outlined above.

Strategies for Managing Medicare Part B Costs:

While the cost of Medicare Part B is a significant factor for many seniors, there are strategies to manage these expenses:

- Enroll in Medicare during the Initial Enrollment Period: Individuals turning 65 can enroll in Medicare during their Initial Enrollment Period without facing penalties. This period typically lasts for a seven-month window around their birthday.

- Consider a Medicare Advantage Plan: Medicare Advantage plans, offered by private insurance companies, can offer lower premiums and additional benefits compared to traditional Medicare. However, these plans may have limitations on coverage and provider networks.

- Explore Low-Income Subsidies: Individuals with limited income and resources may qualify for low-income subsidies that can help reduce the cost of Medicare Part B premiums.

Frequently Asked Questions (FAQs):

Q: When is the 2025 Medicare Part B premium announced?

A: The Centers for Medicare and Medicaid Services (CMS) typically announces the Medicare Part B premium for the following year in the fall.

Q: How can I learn more about the 2025 Medicare Part B premium?

A: The most reliable source of information is the CMS website. Stay updated on their announcements and publications for the latest details on premium adjustments.

Q: What happens if I cannot afford the Medicare Part B premium?

A: If you cannot afford the premium, contact the Social Security Administration or your local Medicare office to explore options like low-income subsidies or other financial assistance programs.

Tips for Seniors:

- Review your Medicare coverage annually: Ensure your plan continues to meet your health needs and explore alternative options if necessary.

- Stay informed about Medicare changes: Keep up-to-date on policy changes and potential premium adjustments by reading publications from the CMS and reputable healthcare news sources.

- Consult with a Medicare advisor: A Medicare advisor can help you navigate the complexities of Medicare and find the most appropriate plan for your situation.

Conclusion:

The cost of Medicare Part B is a crucial factor for seniors planning for their healthcare needs. While the exact premium for 2025 remains unknown, understanding the factors influencing these costs and exploring available strategies for managing expenses can help seniors make informed decisions about their healthcare coverage. By staying informed and proactive, individuals can ensure they receive the necessary medical care while managing their healthcare budget effectively.

![]()

Closure

Thus, we hope this article has provided valuable insights into Understanding Medicare Part B Premiums in 2025: A Guide for Seniors. We thank you for taking the time to read this article. See you in our next article!