Understanding Medicare Part B Premiums in 2025: A Guide to Income-Related Adjustments

Understanding Medicare Part B Premiums in 2025: A Guide to Income-Related Adjustments

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding Medicare Part B Premiums in 2025: A Guide to Income-Related Adjustments. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding Medicare Part B Premiums in 2025: A Guide to Income-Related Adjustments

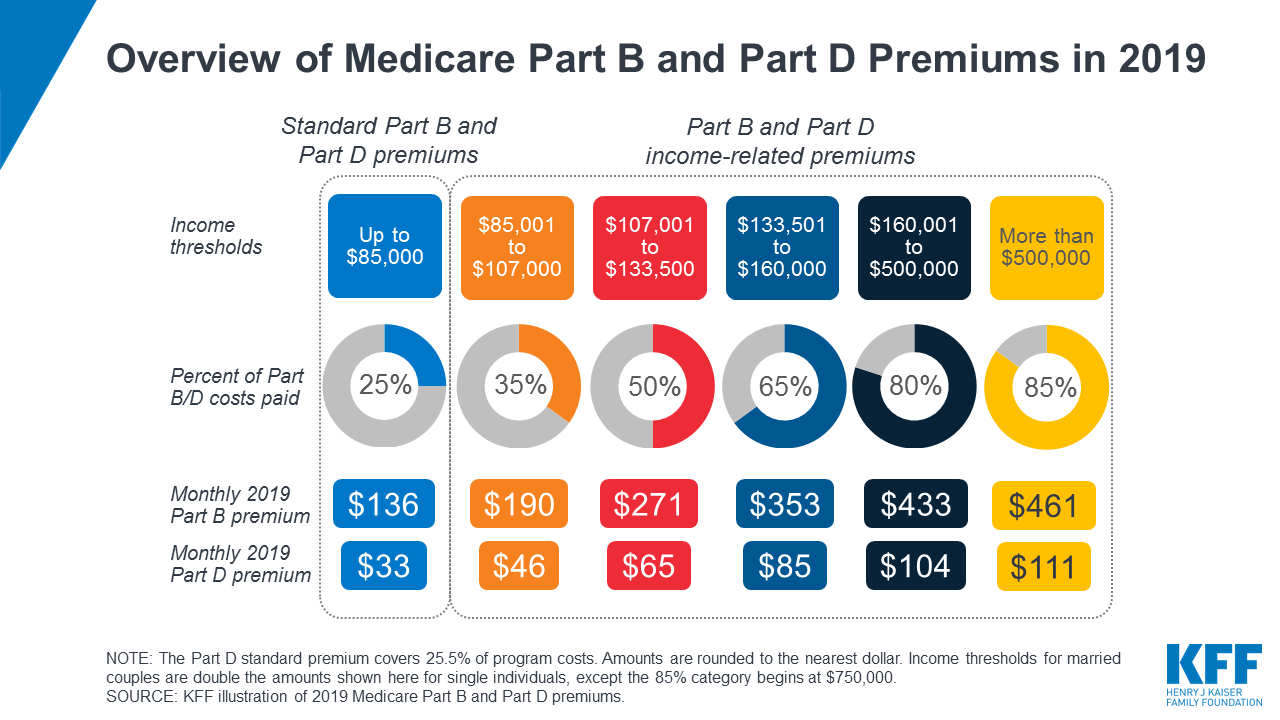

Medicare Part B, which covers physician services, outpatient care, and other medical services, is an essential component of the Medicare program for millions of Americans. However, the cost of Part B coverage can vary significantly based on an individual’s income. The Medicare program implements a system of income-related adjustments to ensure that those with higher incomes contribute more towards the program’s costs. This article provides a comprehensive overview of these adjustments for 2025, highlighting their significance and implications for individuals approaching retirement or already enrolled in Medicare.

Income-Related Monthly Adjustment Amounts (IRMAA): A Key Concept

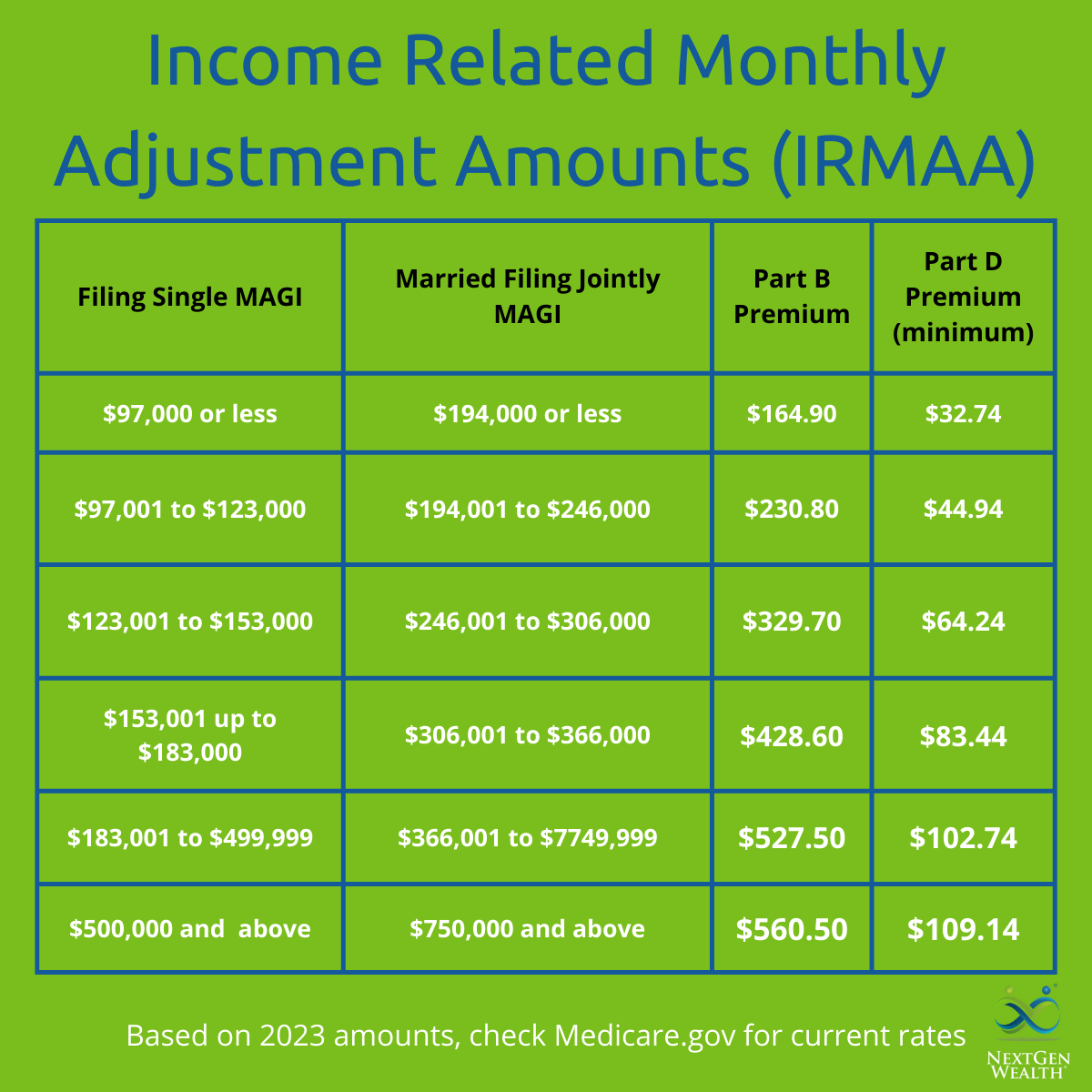

The concept of income-related monthly adjustment amounts (IRMAA) forms the core of the Medicare Part B premium adjustment system. IRMAA applies to individuals who have income exceeding certain thresholds. This means that those with higher incomes will pay a higher monthly premium for Part B coverage than those with lower incomes. The rationale behind this system is to ensure that individuals with greater financial resources contribute proportionally more towards the costs of the Medicare program.

Understanding the 2025 IRMAA Thresholds and Premium Adjustments

To determine the applicable premium for 2025, Medicare uses the individual’s "modified adjusted gross income" (MAGI) reported on their most recent federal tax return. This income includes sources like wages, salaries, pensions, interest, dividends, and capital gains. The MAGI thresholds for 2025 and the corresponding monthly Part B premiums are outlined in the table below:

| MAGI Threshold (Single Filers) | MAGI Threshold (Married Filing Jointly) | Monthly Part B Premium |

|---|---|---|

| $0 – $91,000 | $0 – $182,000 | $164.90 |

| $91,001 – $114,000 | $182,001 – $228,000 | $212.40 |

| $114,001 – $151,000 | $228,001 – $302,000 | $266.90 |

| $151,001 – $178,000 | $302,001 – $356,000 | $321.40 |

| $178,001 and above | $356,001 and above | $412.40 |

Important Considerations for 2025

- Annual Adjustment: The MAGI thresholds and corresponding premiums are subject to annual adjustments based on inflation and other economic factors. It is crucial to refer to official Medicare resources for the most up-to-date information.

- Joint Filers: For married couples filing jointly, the MAGI thresholds are doubled, as illustrated in the table above.

- Medicare Advantage Plans: While IRMAA applies to traditional Medicare Part B, it does not affect Medicare Advantage plans. These plans are offered by private insurance companies and may have their own premium structures.

- Income-Related Adjustments for Other Medicare Benefits: Similar income-related adjustments also apply to Medicare Part D prescription drug coverage.

FAQs Regarding 2025 Medicare Part B Premium Income Limits

Q: How are my MAGI and Part B premiums determined?

A: The Social Security Administration (SSA) uses your most recent federal tax return to calculate your MAGI. Based on this income, they determine the appropriate Part B premium for the upcoming year.

Q: Can I appeal a premium adjustment based on my income?

A: Yes, you can appeal a premium adjustment if you believe it is incorrect. You can do this by contacting the SSA or the Medicare appeals office. Be prepared to provide supporting documentation for your appeal.

Q: What if my income changes during the year?

A: If your income changes significantly during the year, you may be able to request a premium adjustment. However, this requires documentation and may not be possible in all circumstances.

Q: Can I reduce my MAGI to lower my Part B premium?

A: While you cannot directly influence your MAGI, there are strategies that may help reduce it, such as contributing to a Roth IRA or utilizing tax-advantaged savings accounts.

Tips for Managing 2025 Medicare Part B Premiums

- Plan Ahead: Consult with a financial advisor to understand your financial situation and explore strategies for mitigating potential premium increases.

- Consider Your Income: Be mindful of your income sources and how they may affect your MAGI.

- Stay Informed: Regularly check official Medicare websites for updates on income thresholds and premium adjustments.

- Seek Assistance: If you have questions or require assistance navigating the Medicare system, reach out to the Medicare helpline or a local Medicare counselor.

Conclusion

Understanding the income-related adjustments for Medicare Part B premiums is crucial for individuals approaching or already in retirement. By being aware of the MAGI thresholds and potential premium changes, individuals can proactively plan for their healthcare expenses and make informed decisions regarding their Medicare coverage.

Closure

Thus, we hope this article has provided valuable insights into Understanding Medicare Part B Premiums in 2025: A Guide to Income-Related Adjustments. We thank you for taking the time to read this article. See you in our next article!