Understanding Medicare Part B Premiums in 2025 for Seniors Over 65

Understanding Medicare Part B Premiums in 2025 for Seniors Over 65

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding Medicare Part B Premiums in 2025 for Seniors Over 65. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding Medicare Part B Premiums in 2025 for Seniors Over 65

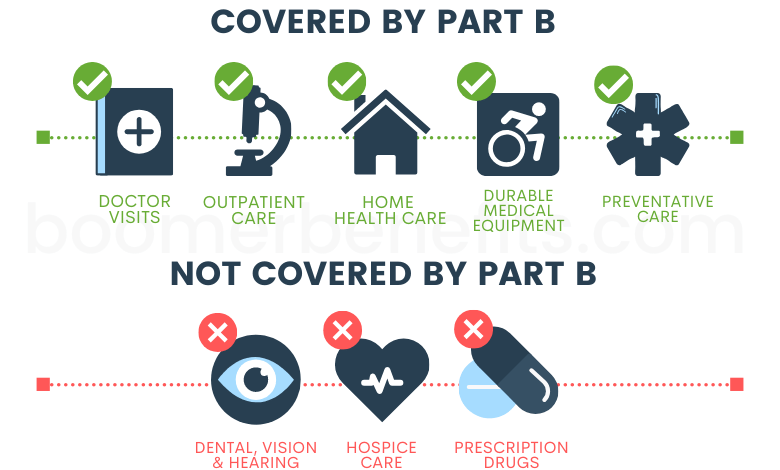

Medicare Part B, the medical insurance component of the Medicare program, covers a wide range of services, including doctor visits, outpatient care, and preventive screenings. The cost of Part B is determined by a monthly premium, which varies depending on individual income and other factors. While the exact premium for 2025 is not yet finalized, understanding the factors that influence these costs and how they are determined is crucial for seniors and their families.

Factors Influencing Medicare Part B Premiums:

Several factors contribute to the annual adjustment of Medicare Part B premiums:

- Inflation: The Consumer Price Index (CPI) serves as a key indicator of inflation. The Centers for Medicare and Medicaid Services (CMS) uses CPI data to determine the annual cost-of-living adjustment (COLA) for Social Security benefits. This COLA also influences the adjustment of Medicare Part B premiums.

- Healthcare Costs: The rising costs of medical services, treatments, and prescription drugs play a significant role in premium adjustments. As healthcare costs increase, so too do the premiums needed to fund the program.

- Enrollment Numbers: The number of individuals enrolled in Medicare Part B can affect premiums. A larger pool of enrollees can, in theory, lead to lower premiums per individual due to a larger base to spread costs.

- Government Spending: Government spending on Medicare can impact premiums. Reduced government funding can lead to higher premiums to compensate for the shortfall.

How Premiums are Determined:

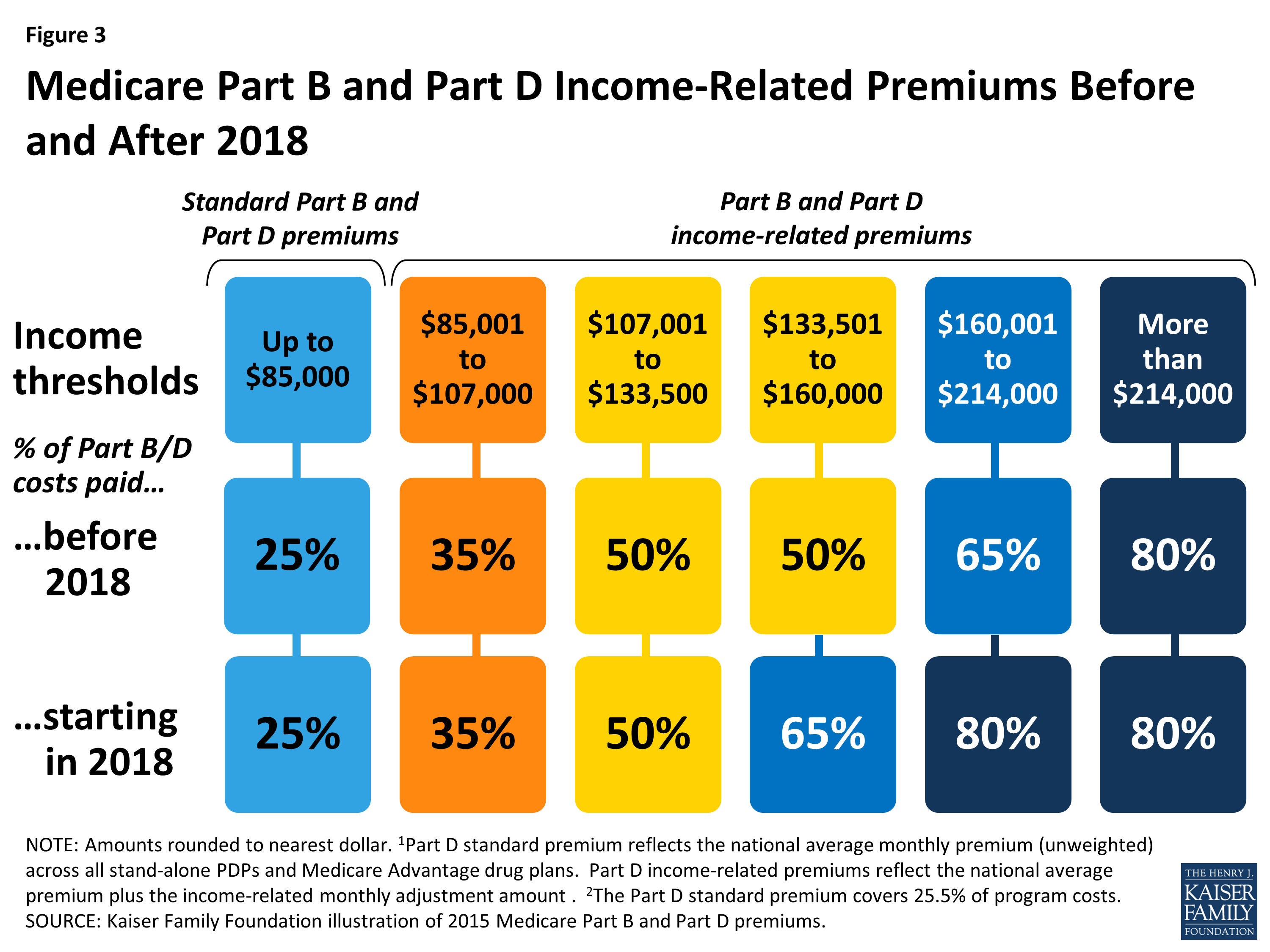

The CMS uses a complex formula to determine the Medicare Part B premium each year. The formula takes into account the factors outlined above and adjusts the premium accordingly. The standard monthly premium for 2024 is $164.90. The 2025 premium will be announced closer to the end of the year.

Importance of Understanding Part B Premiums:

Understanding the factors that influence Medicare Part B premiums is essential for seniors and their families for several reasons:

- Budgeting: Knowing the potential cost of Medicare Part B allows individuals to plan their finances and ensure they can afford the necessary medical coverage.

- Planning for Future Expenses: Understanding the potential for premium increases can help individuals prepare for future healthcare expenses and make necessary adjustments to their budgets.

- Making Informed Decisions: Understanding the nuances of Medicare Part B premiums empowers individuals to make informed decisions about their healthcare coverage and explore alternative options if needed.

FAQs Regarding Medicare Part B Premiums for Seniors Over 65:

1. Who is eligible for Medicare Part B?

Most individuals aged 65 and over are eligible for Medicare Part B, along with certain individuals with disabilities and those with end-stage renal disease.

2. How are premiums paid?

Medicare Part B premiums are typically deducted directly from Social Security benefits. If an individual does not receive Social Security, they will receive a bill from the Medicare program.

3. Can I avoid paying Part B premiums?

Individuals can choose to opt out of Medicare Part B, but they will need to pay a late enrollment penalty if they decide to enroll later.

4. What happens if I can’t afford the Part B premium?

The Medicare program offers financial assistance programs, such as the Low-Income Subsidy (LIS), to help eligible individuals afford their Part B premiums.

5. How often are Part B premiums adjusted?

Medicare Part B premiums are adjusted annually based on the factors outlined above.

Tips for Managing Medicare Part B Premiums:

- Review your income: Understand your income level and how it may affect your Medicare Part B premiums.

- Explore financial assistance: If you are struggling to afford the premiums, investigate eligibility for financial assistance programs like the LIS.

- Consider alternative coverage: Explore other health insurance options if you believe Medicare Part B is too expensive.

- Stay informed: Keep up-to-date on changes to Medicare Part B premiums and other program details.

Conclusion:

Medicare Part B premiums are a significant aspect of healthcare planning for seniors over 65. Understanding the factors that influence these premiums, how they are determined, and available resources for financial assistance empowers individuals to make informed decisions about their healthcare coverage and manage their finances effectively. By staying informed and proactive, seniors can navigate the complexities of Medicare Part B and ensure they have access to the necessary medical care.

![]()

Closure

Thus, we hope this article has provided valuable insights into Understanding Medicare Part B Premiums in 2025 for Seniors Over 65. We hope you find this article informative and beneficial. See you in our next article!