Understanding the 2025 Medicare Part B Premium Increase: A Guide for Seniors

Understanding the 2025 Medicare Part B Premium Increase: A Guide for Seniors

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding the 2025 Medicare Part B Premium Increase: A Guide for Seniors. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the 2025 Medicare Part B Premium Increase: A Guide for Seniors

Medicare Part B, which covers doctor’s visits, outpatient care, and certain medical supplies, is a vital component of healthcare for millions of seniors. However, the annual premium for this program can fluctuate, and understanding these changes is crucial for beneficiaries to effectively manage their healthcare expenses.

The 2025 Medicare Part B premium increase, as announced by the Centers for Medicare & Medicaid Services (CMS), presents a significant factor in healthcare budgeting for seniors. This article will delve into the intricacies of this increase, its implications for beneficiaries, and provide valuable insights for navigating the complexities of Medicare Part B.

Factors Influencing the Premium Increase:

The annual Medicare Part B premium is determined by a complex formula that considers several key factors:

- Projected Healthcare Costs: The single largest factor influencing the premium is the anticipated increase in healthcare costs for the coming year. As medical technology advances and the demand for healthcare services grows, costs tend to rise, leading to corresponding adjustments in the Medicare Part B premium.

- Utilization Rates: The frequency and intensity of healthcare services used by beneficiaries directly impact the premium. Higher utilization rates mean greater overall costs for the program, which are then reflected in the premiums.

- Economic Conditions: Broad economic trends, such as inflation and interest rates, also play a role in premium adjustments. These factors can influence the overall cost of healthcare services and the financial health of the Medicare program.

- Legislative Changes: Any changes to Medicare law or regulations can impact the premium structure. For instance, the introduction of new benefits or modifications to existing programs can necessitate adjustments in premium levels.

The 2025 Premium Increase: A Closer Look:

The 2025 Medicare Part B premium increase, while reflecting the broader trends mentioned above, is particularly notable due to the following:

- Higher-than-Average Increase: The projected increase for 2025 is significantly higher than in recent years, exceeding the rate of inflation. This implies that beneficiaries will face a more substantial financial burden compared to previous years.

- Impact on Beneficiaries’ Budgets: The increased premium will directly affect beneficiaries’ out-of-pocket healthcare expenses, potentially leading to budget constraints and a need to adjust spending habits.

- Potential for Deductible Changes: Alongside the premium increase, there may also be adjustments to the Part B deductible, which represents the amount beneficiaries pay before Medicare begins covering costs. This double whammy can further impact the overall financial burden.

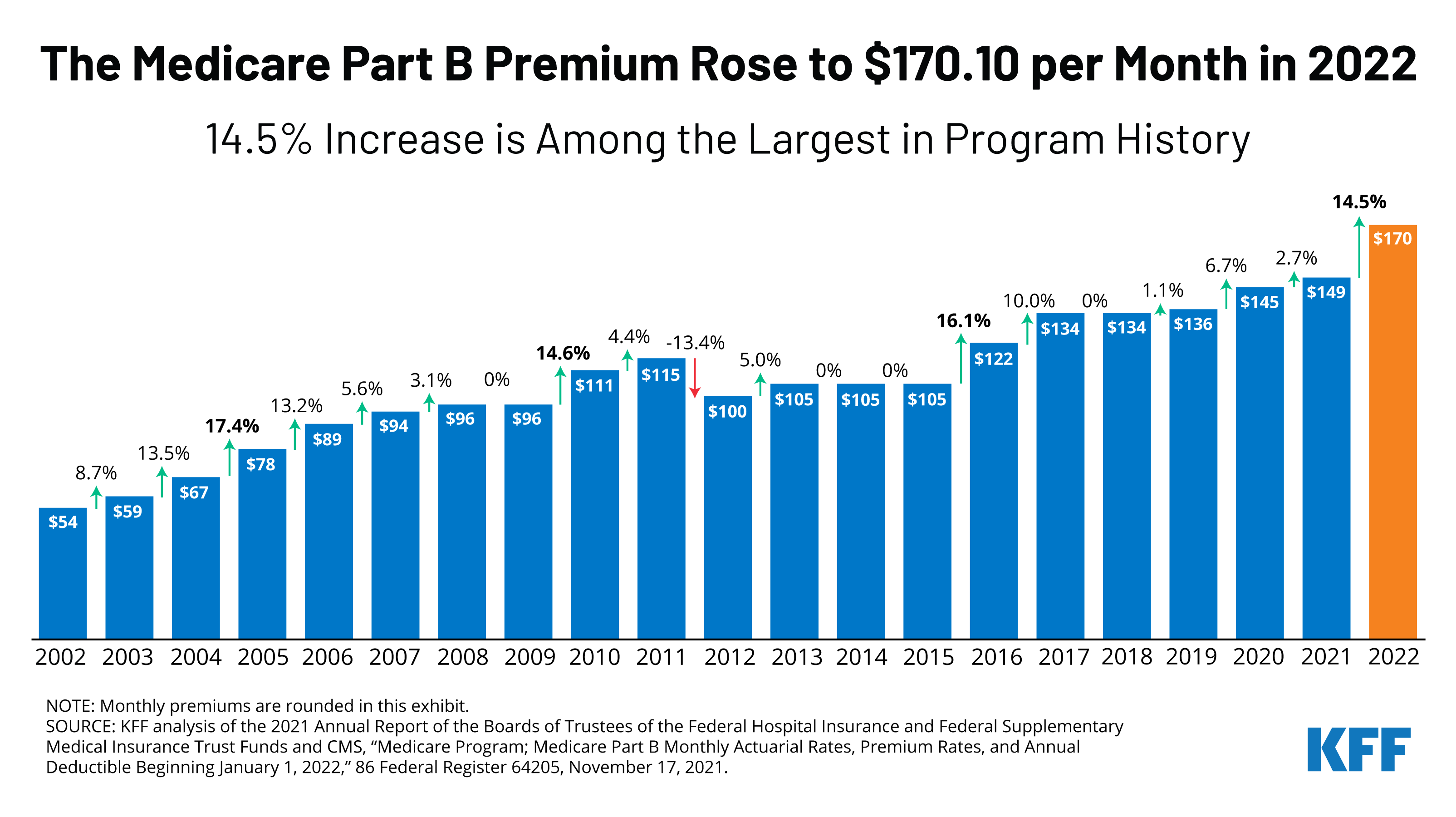

Understanding the Chart:

The 2025 Medicare Part B premium increase chart, released by CMS, provides a visual representation of the anticipated changes. This chart typically displays:

- Standard Monthly Premium: The base monthly premium for Medicare Part B, which is applicable to most beneficiaries.

- Income-Related Monthly Adjustment Amount (IRMAA): For higher-income beneficiaries, the standard premium is adjusted based on their income levels. This chart will illustrate the IRMAA amounts for various income brackets.

- Deductible Amount: The chart will also indicate the deductible amount beneficiaries will need to pay before Medicare begins covering costs for covered services.

Navigating the Increase:

While the 2025 Medicare Part B premium increase poses a challenge for beneficiaries, there are strategies to mitigate its impact:

- Reviewing Enrollment Status: Ensure you are enrolled in the most appropriate Medicare plan, considering your individual needs and budget.

- Exploring Cost-Saving Options: Utilize available resources like preventive screenings and health education programs to manage health conditions and reduce healthcare costs.

- Seeking Financial Assistance: If facing financial hardship, explore options like Medicare Savings Programs (MSPs) or other financial assistance programs to offset the premium burden.

- Engaging in Advocacy: Stay informed about Medicare policies and engage in advocacy efforts to ensure fair and affordable healthcare for seniors.

FAQs by 2025 Medicare Part B Premium Increase:

Q: What is the exact percentage increase in the 2025 Medicare Part B premium?

A: The exact percentage increase will be announced by CMS in the fall of 2024, and it will vary based on individual circumstances.

Q: How does the income-related monthly adjustment amount (IRMAA) impact the premium?

A: IRMAA applies to beneficiaries with higher incomes, resulting in a higher premium. The chart will show the specific IRMAA amounts for different income brackets.

Q: Are there any resources available to help seniors with the premium increase?

A: Yes, several resources are available, including Medicare Savings Programs (MSPs) and other financial assistance programs.

Q: How can I stay informed about future Medicare premium adjustments?

A: Stay updated by subscribing to CMS notifications, checking Medicare.gov, and reading news articles about Medicare updates.

Tips by 2025 Medicare Part B Premium Increase:

- Budget for the Premium Increase: Factor in the anticipated increase into your healthcare budget to avoid unexpected financial strain.

- Explore Medicare Advantage Plans: Consider switching to a Medicare Advantage plan, which may offer lower premiums and additional benefits.

- Negotiate with Providers: Discuss payment options and explore ways to reduce healthcare costs with your providers.

Conclusion by 2025 Medicare Part B Premium Increase:

The 2025 Medicare Part B premium increase represents a significant financial challenge for seniors. However, by understanding the factors driving the increase, utilizing available resources, and engaging in proactive planning, beneficiaries can navigate this change effectively and maintain access to essential healthcare services. Staying informed, exploring cost-saving options, and advocating for affordable healthcare are crucial steps in ensuring a secure and healthy future for seniors.

Closure

Thus, we hope this article has provided valuable insights into Understanding the 2025 Medicare Part B Premium Increase: A Guide for Seniors. We hope you find this article informative and beneficial. See you in our next article!