Understanding the 2025 Medicare Part B Premium Increase: A Guide for Seniors

Understanding the 2025 Medicare Part B Premium Increase: A Guide for Seniors

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding the 2025 Medicare Part B Premium Increase: A Guide for Seniors. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the 2025 Medicare Part B Premium Increase: A Guide for Seniors

Medicare Part B, which covers physician services, outpatient care, and other medical services, is a vital component of healthcare for many seniors. However, the annual premium for Part B is subject to adjustments, and these changes can significantly impact beneficiaries’ budgets. This article provides an in-depth explanation of the 2025 Medicare Part B premium increase, its potential impact on seniors, and offers guidance on navigating this aspect of healthcare financing.

The Mechanics of Premium Adjustments

The Medicare Part B premium is adjusted annually based on several factors, primarily:

- The projected cost of Medicare benefits: The Centers for Medicare and Medicaid Services (CMS) estimates the cost of providing Part B benefits in the coming year. These projections are based on factors like anticipated utilization rates, technological advancements, and drug pricing.

- The Social Security trust fund: The Social Security trust fund provides a significant portion of the funding for Medicare Part B. Changes in the financial health of this trust fund can influence premium adjustments.

- The average income of beneficiaries: The government considers the average income of Medicare beneficiaries to ensure premiums are fair and equitable.

Understanding the 2025 Premium Increase

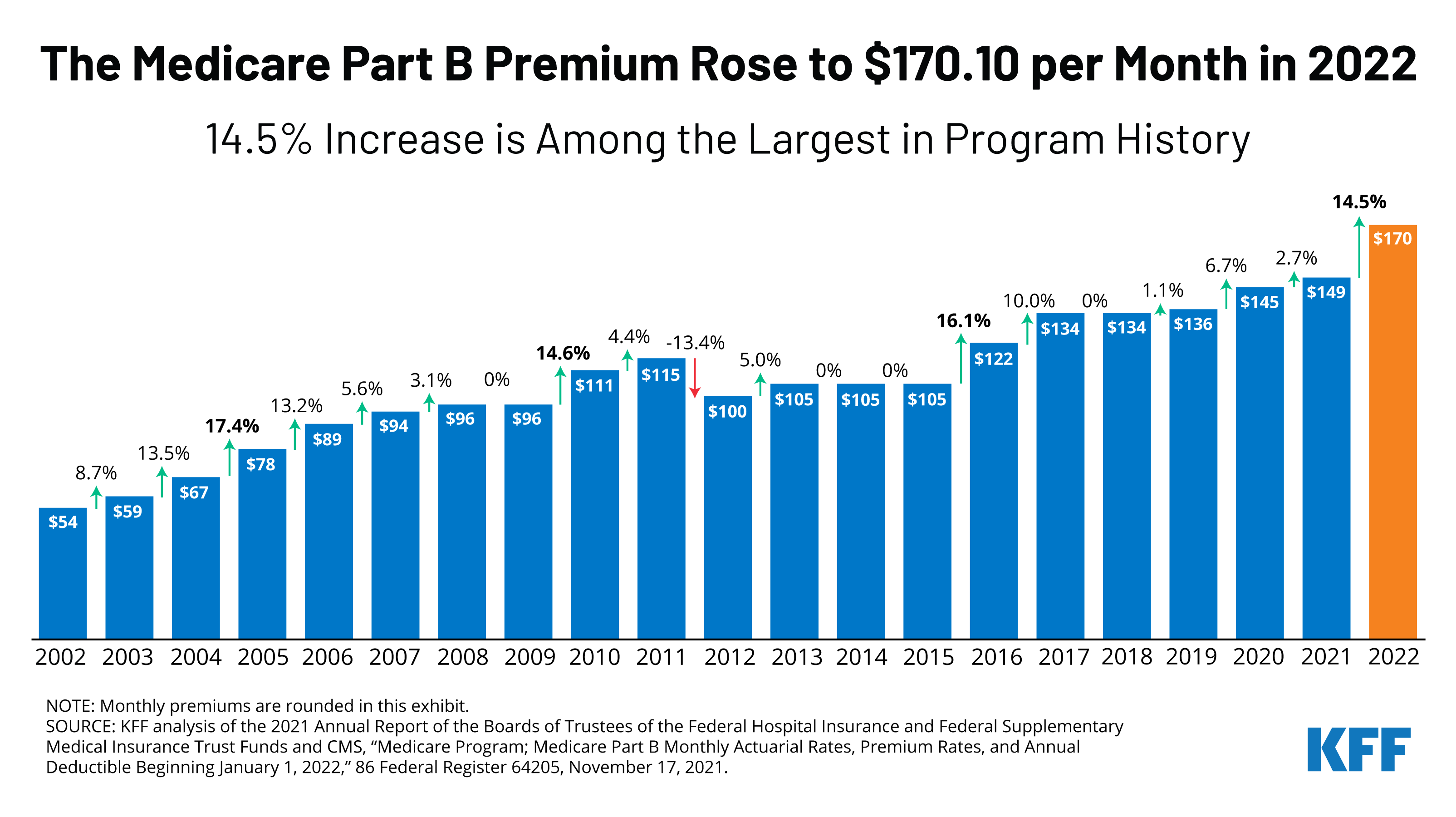

While the specific premium amount for 2025 will not be finalized until late 2024, analysts and experts anticipate a moderate increase. This increase is likely driven by several factors, including rising healthcare costs, advancements in medical technology, and the continued growth of the Medicare beneficiary population.

Navigating the Increase: Strategies for Seniors

The projected increase in Medicare Part B premiums for 2025 underscores the importance of proactive financial planning for seniors. Here are some strategies to help mitigate the impact of these changes:

- Review and adjust your budget: Analyze your current expenses and identify areas where savings can be made. Consider adjusting your lifestyle to accommodate the potential premium increase.

- Explore supplemental insurance: Medicare Supplement Insurance (Medigap) policies can help cover out-of-pocket expenses, including Part B premiums. Consult with an insurance broker to determine if Medigap is a suitable option for your individual needs.

- Consider Medicare Advantage plans: Medicare Advantage plans are offered by private insurance companies and can provide comprehensive coverage, including prescription drugs, at potentially lower premiums than traditional Medicare. However, it’s crucial to carefully compare plans and their coverage details.

- Utilize available resources: Contact your local Senior Center or Area Agency on Aging for information on programs and resources that can assist with healthcare costs.

FAQs Regarding the 2025 Medicare Part B Premium Increase

Q: When will the 2025 premium amount be announced?

A: The official announcement of the 2025 Medicare Part B premium is typically made in late October or early November of the preceding year.

Q: How can I find out my current Part B premium?

A: Your Medicare card will indicate your current monthly premium. You can also find this information on the Medicare website or by contacting the Medicare hotline.

Q: If I cannot afford the premium increase, what options are available?

A: If you are facing financial hardship, contact your local Social Security office or the Medicare hotline to explore options like the "Low-Income Subsidy" program, which can help offset the cost of Part B premiums.

Q: Will the premium increase affect my other Medicare benefits?

A: The premium increase applies specifically to Part B coverage. Your benefits under Part A (hospital insurance) will not be affected.

Tips for Seniors

- Stay informed: Regularly check the Medicare website and other reliable sources for updates on premium changes and other important Medicare news.

- Seek professional advice: Consult with a financial advisor or Medicare specialist to discuss your individual circumstances and develop a personalized plan for managing healthcare costs.

- Engage in healthy habits: Maintaining good health can reduce your healthcare expenses in the long run.

Conclusion

The 2025 Medicare Part B premium increase is a significant factor for seniors to consider when planning for their healthcare needs. Understanding the factors contributing to these adjustments, exploring available resources, and taking proactive steps to manage healthcare costs are crucial for navigating this aspect of Medicare. By staying informed and implementing appropriate strategies, seniors can ensure continued access to quality healthcare while managing their finances effectively.

Closure

Thus, we hope this article has provided valuable insights into Understanding the 2025 Medicare Part B Premium Increase: A Guide for Seniors. We thank you for taking the time to read this article. See you in our next article!